Transformers form critical components of a power grid, and hence, India's cherished power sector

ambitions depend squarely on the capability of the transformer industry to deliver. Be it transmitting power

at ultra-high levels of 1,200kV or reaching power to the remotest of villages, a transformer is an

indispensable and all-important link in the power chain. The Indian transformer industry has for long been

traditional but is now seen maturing rapidly. However, there are several challenges on the road ahead that

need to be tackled deftly. Only this will ensure that the transformer industry efficiently takes up the big "load"

of responsibility lying in store, notes

Venugopal Pillai.

The Indian transformer industry—including ony

power and distribution transformers—is estimated to

have grown by 14 per cent in FY11, according to

statistics released by IEEMA. The industry size is an

estimated

14,754 crore. However, this could be an

underestimate as it is based only on information compiled

from IEEMA members. India has a big class of small-scale

distribution transformers of whom physical and financial

data is difficult to obtain.

According to forecasts made by Electrical Monitor, domestic

production of transformers is likely to reach 2.3 lakh MVA in

FY12, up from an estimated 1.91 lakh MVA in FY11 and 1.53

lakh MVA in FY10. Capacity utilization of the Indian

transformer industry, as reliable statistics suggest, is between

65 and 75 per cent. The average annual production of

transformers has been rising steadily from 47,000 MVA in the

IX Plan (1997-02) to 83,000 MVA in the X Plan (2002-07). The

ongoing XI Plan has seen the highest ever average annual

production of around 1.7 lakh MVA.

Performance of Transformers: 2008-09 to 2010-11 |

|

Weight |

Market* |

y-o-y % change |

| |

(%) |

( crore) crore) |

2008-09 |

2009-10 |

2010-11 |

| Transformers |

24.9 |

14,754 |

-1.2 |

9.1 |

15.0 |

| Power Transformers |

10.7 |

6,181 |

25.8 |

17.2 |

13.0 |

| Distribution Transformers |

14.2 |

8,572 |

-16.9 |

3.0 |

16.0 |

| Total** |

100.0 |

58,315 |

2.7 |

11.3 |

14.0 |

| Source: IEEMA; *Estimated industry size in 2010-11;**For entire electricals industry |

In terms of MVA (MegaVolt Ampere-the unit for measuring

a transformer's capacity) power transformers account for 65

per cent while distribution transformers have a 35 per cent

share. (See Box: Power and distribution transformers). In the

current Indian context, a power transformer has a rating from

11kV to 765kV, whereas a transformer with rating from 1.1kV

to 11kV is termed as a distribution transformer.

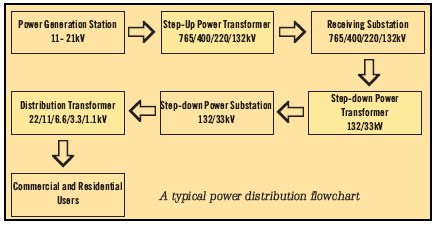

Power and distribution transformers |

Transformers are essentially devices that

are used to change voltage in the power

transmission and distribution process, with

minimum loss of energy. A power

transformer is installed at all points starting

from the source (power generation plant) up

to the last substation, just before

distribution of power starts. Depending on

whether the transformer causes an upward

or downward change in voltage, these are

called "step-up" or "step-down"

transformers. Power transformers are

usually oil-filled and are above the 33kV

range and above 10 MVA capacity. In India,

power transformers up to 765kV are

currently under commercial use.

A distribution transformer is a step-down

transformer that is used to convert highvoltage

power supply into low-voltage

supply for the end user. This stepping down

is usually done from the 33kV level to the

1.1kV level. Distribution transformers could

be oil-filled or of the dry type. As

distribution transformers are physically

closer to the end-users, safety is an

important consideration. Given that dry

transformers are less likely to explode than

the oil-filled variant, they are given

increasing preference despite the higher

capital costs. Dry-type transformers, apart

from offering higher safety, also take up less

space. Due to this, such transformers are

increasingly being used in commercial

applications like metro stations, malls,

cinema halls, hospitals, high-rise

buildings, etc. Currently, dry-type

distribution transformers account for only

10-12 per cent of the total production of

distribution transformers.  |

Power utilities account for 70 per cent of the total

transformers consumed, followed by power-centric industrial

consumers (steel, cement, fertilizers, etc) that take up 20 per

cent. An estimated 10 per cent of Indian transformers are

exported. While principal export destinations have been

developing economies like Central Asia and Africa, Indian

transformers are also finding their way to developed countries

like USA, UK, Canada, etc.

GROWTH DRIVERS

Principal growth drivers to the power and distribution

transformers are discussed below.

XII Plan period: Growth of the transformer industry

would be linked squarely to the quantum of investment that

India commits to the power T&D sector. Traditionally, power

T&D has been a grossly neglected area. In an ideal situation,

every rupee spent in creating power generation facilities has to

be matched by an equal amount in setting up power T&D

infrastructure. This ratio of 1:1 has never been honoured in

India. Experts feel that at best investment in T&D has been 50

per cent of that in power generation, as against the desirable

100 per cent. The ensuing XII Plan period (April 2012 to March

2017) is expected to be radically different from its predecessors.

According to government estimates, India is expected to see an

investment of

13 trillion in the XII Plan. This will be equally

distributed—for the first time ever—between generation and

T&D. This by itself is the biggest growth driver for the

transformer industry.

The transmission sector is likely to see investment of

2.5

trillion in the XII Plan period with

4 trillion going towards power distribution projects. The demand for transformers can

be gauged from the fact that 15 per cent of the total cost of a

typical transmission projects goes towards transformers.

Hence, the business opportunity size for transformers coming

purely from transmission projects is

37,500 crore in the XII

Plan period. This translates into an addressable market of

7,500 crore per year.

The demand for transformers can also be viewed from

another angle. The traditional thumb rule has been that

every mw of new power generation capacity needs 7 MVA of

transformation capacity. In the XII Plan period, India is

expected to witness aggregate new power generation

capacity of 75,000 mw. This would need transformation

capacity of 525,000 MVA during the entire Plan period, or

105,000 MVA per year. Independently, the power ministry

has estimated that in the entire XII Plan period, around

150,000 MVA of new transformation capacity would be

installed at the 220kV level alone. The rule of 7 MVA per mw

was true at a time when India's transmission infrastructure

was largely of the 220kV type with sporadic instances of

400kV lines. Now, India has progressed to even 765kV lines

and therefore, as some transformer manufacturers point

out, the standard transformation metric in the coming

years, would be around 11 MVA per mw of new power

generation capacity.

Mandatory Star Labeling |

The growing tribe of distribution transformer manufacturers in

the unorganized sector and the poor quality of their equipment

has been a longstanding cause for concern. The number of such

manufacturers is inestimable as they are never part of formal

bodies like industry associations. Industry sources allege that the

sheer survival of these manufacturers is due to the unfortunate

collusion that has, perhaps inadvertently, developed with power

utilities. As these manufacturers do not exercise quality control or

use prime material, they can afford to quote prices that are

impossible for any quality-conscious producer to match. As

power utilities are bound by the L1 criteria, these manufacturers

qualify as suppliers. This ensures their subsistence and, worse,

contaminates the power T&D grid with inefficient equipment.

In January 2010, the Bureau of Energy Efficiency (BEE) made it

compulsory for distribution transformers to have a "star labeling".

This was done with a view to ensuring energy efficiency. In the

context of transformers, it means low energy loss during the

process of transformation. The industry has welcomed this move

and it is expected that the overall quality of distribution

transformers would improve significantly. Marginal players would

now be forced to improve their product quality or exit the business.

Either way, it is in universal interest.

While welcoming the move, transformer manufacturers also feel

that the process of BEE certification should be standardized and

type-testing should be obviated to the extent possible. There are

cases when a transformer supplier has BEE-certified equipment

but a slight variation in specification (sought by power utilities)

causes the supplier to undergo the type-testing and BEEcertification

process all over again.

|

Role of PGCIL: When it comes to very large power

transformers, Central transmission utility Power Grid

Corporation of India Ltd (PGCIL) is a big consumer. The

National Grid project that aims to facilitate seamless power

exchange between the five regional grids is PGCIL's flagship

project. As of September 2011, this interregional transfer

capacity (IRTC) stood at 23,800 mw. The original target was

to attain IRTC of 37,150 mw by March 2012, the end of the XI

Plan period. However, this target has now been scaled down

to 32,650 mw. Considering that 8,850 mw of capacity is to be

set up within 18 months (September 2011 to March 2012) if

the target were to be honoured, PGCIL is expected to expedite

the project resulting in a surge in demand for high-rating

power transformers.

PGCIL is likely to incur capital expenditure of

1 lakh crore

in the XII Plan period (2012-17), significantly higher than an

estimated

55,000 crore in the ongoing XI Plan. Going by the

norm that 15 per cent cost of a transmission project is towards

transformers, PGCIL is likely to spend

15,000 crore to this

effect during the entire XII Plan period.

R-APDRP:

R-APDRP: The Central government's Restructured

Accelerated Power Development & Reforms Programme (R-APDRP)

that aims to bring down ATC losses is construed as a

big demand driver for both power and distribution

transformers. R-APDRP aims to bring down aggregate

technical & commercial (ATC) losses in project areas to 15 per

cent. This nationwide programme is urban-centric, touching

cities and towns with a population of 30,000 or more. Apart

from transformers, R-APDRP calls for a large number of

products and services including sophisticated IT and telecomrelated

ones.

As R-APDRP aims at bring about efficiency in the power

transmission and distribution chain, the programme would

involve replacement of old transformers with more efficient

ones. R-APDRP has also resulted in a spurt in demand for pole-mounted distribution transformers, industry sources point

out. Besides, in some urban areas, higher-rating power

transformers are also being installed close to distribution areas,

with a view to reducing "step-down" losses.

India sets 1,200kV world record |

A big endorsement to India's indigenous

manufacturing capabilities has come in

the form of the 1,200kV transformer range.

These ultra-high voltage transformers will

form an integral part of India's ambitions of

transmitting power at 1,200kV levels - the

highest in the world so far. Power Grid

Corporation of India, in association with

domestic manufacturers, is in the midst of a

pilot project at Bina in Madhya Pradesh to

test equipment and monitor live conditions,

preparing the ground for commercial use of

1,200kV power transmission. A big endorsement to India's indigenous

manufacturing capabilities has come in

the form of the 1,200kV transformer range.

These ultra-high voltage transformers will

form an integral part of India's ambitions of

transmitting power at 1,200kV levels - the

highest in the world so far. Power Grid

Corporation of India, in association with

domestic manufacturers, is in the midst of a

pilot project at Bina in Madhya Pradesh to

test equipment and monitor live conditions,

preparing the ground for commercial use of

1,200kV power transmission.

According to the best of Electrical Monitor's

knowledge, four domestic manufacturers

have so far built 1,200kV transformers that

are being deployed at the Bina test station.

The four companies include public sector

unit Bharat Heavy Electricals Ltd and three in

the private sector - Crompton Greaves, Areva

T&D India (now part of Alstom Grid) and Vijai

Electricals. Here is a brief summary.

Areva T&D (India) Ltd: The power

transmission business of Areva T&D India,

now part of Alstom Grid, flagged of India's

first 1,200kV capacitive voltage transformer

(CVT) from its Hosur plant in Tamil Nadu.

The CVT, shipped in October this year, will

be deployed at Power Grid Corporation of

India's 1,200kV Bina test station in Madhya

Pradesh. Apart from the CVT, Areva T&D

India will support the project with

disconnectors and digital current

transformers. All these equipments will be

produced at the Hosur and Chennai factories

in Tamil Nadu.

Bharat Heavy Electricals Ltd: In July this

year, BHEL announced that it had developed

the country's first indigenous 1,200kV ultra

high voltage alternating current (UHVAC)

transformer of 333 MVA rating. The

transformer has developed, manufactured

and successfully tested by BHEL entirely

through in-house know-how. In addition, the

company has manufactured and installed a

1200kV, 180 MVA transformer to be used as

a testing transformer in its UHV Test

Laboratory at Bhopal. BHEL is also involved

in the supply of other key equipment

including 1,200kV insulators for the Bina

test station.

Crompton & Greaves Ltd: Thapar Group

company Crompton Greaves in December

last year dispatched a 1,200kV capacitive

voltage transformer (CVT) for the Bina test

station. The product developed with

indigenous technology at CG's Nashik plant

in Maharashtra was tested at Central Planning

& Research Institute (CPRI), Hyderabad. CG

has promised to deliver some more

equipment including a 333MVA power

transformer of 1,200kV rating and a 1,200kV

surge arrestor, for PGCIL's Bina test station.

Vijai Electricals Ltd: In July 2011, Hyderabadbased

Vijai Electricals Ltd handed over a

1,200kV transformer to PGCIL. The 333MVA

single-phase power transformer will be used

in PGCIL's 1,200kV test station in Madhya

Pradesh. The mammoth transformer was built

by Vijai Electricals using in-house technology

at its Rudraram works in Hyderabad, Andhra

Pradesh. Vijai recorded this achievement

within just four years of diversifying into

power transformers.

(Apart from these, there are companies like

Transformers & Rectifiers (India) Ltd,

Siemens Ltd and ABB Ltd that are expected

to supply 1,200kV transformers to PGCIL in

the near future.)

|

Replacement Market: Apart from replacement of

inefficient transformers-mainly under RAPDRP-there exists a

big market for replacement of transformers that have outlived

their operational life. A transformer usually lasts for 25-30

years and going by this yardstick, transformers installed in the

1980s will now be due for gradual replacement. It is estimated

that India would need to replace between 18,000 MVA and

20,000 MVA of transformers every year in the medium term.

Given that the new transformers would be far more efficient

that their predecessors, the gradual replacement will also

contribute to efficiency in the power T&D chain.

Exports: India has always been an exporter of transformers

and this avenue is set to becoming even more lucrative in the

coming years. Exports from India are diverse including power

transformers, distribution transformers and even specialpurpose

transformers. It is estimated that around 15 per cent of India's production of power transformers is destined for

international markets. With India proving its technological

edge by producing even 1,200kV transformers, surpassing

global standards, the country has a very bright future, experts

feel. It is not only developing African and Central Asian

economies that are importing from India, India-made

transformers are even finding their way in developed markets

like USA, UK, Canada, etc.

Taking into account all types of transformers, exports from

India are estimated to have grown from 21,000 MVA in 2006-

07 to 30,000 MVA in 2008-09. The performance in recent years

is not known. In physical terms, exports today account for less

than 10 per cent of the total domestic transformer production.

By 2011-12, experts believe that exports would even grow to

over 55,000 MVA.

CHALLENGES

The Indian transformer industry does face serious

challenges, largely relating to lack of enabling infrastructure.

Here is a summary.

The CRGO Imbroglio:

The CRGO Imbroglio: The biggest concern and also the

most widely discussed is inadequate supply of prime quality

electrical steel. Cold rolled grain oriented (CRGO) electrical

steel is a key component that can account for between 40 per

cent and 75 per cent of the manufacturing cost of a

transformer. As of now, there is no domestic production of

CRGO and the entire requirement is met through imports.

World over, there are only around eight companies making

CRGO and the technology is believed to be closely guarded.

Industry players explain that the concern is not with scrap or

prime CRGO, it is simply that there is no way to know the true

quality of the material imported.

Will China "transform" the market? |

A big speculation and apprehension in the

Indian transformer industry today is the

plausible entry of China in the medium term.

Thanks to all the demand drivers discussed

in this study, it is very clear that India will

face an imminent shortage of transformers.

China will be more than interested in

bridging this shortfall. It happened in the

case of main plant power equipment where

China briskly penetrated the market for

boilers and turbine-generators. As India's

focus shifts from power generation to power

T&D, so would China's.

When it comes to power transformers of the

most popular type (220kV to 400kV range),

there is a dearth of domestic manufacturing

capacity. Or rather, the envisaged demand

would be much higher than the existing

domestic capacity available. The demand

for power transformers, which is expected to

at least double over the next 3-4 years, will

also be faster than any capacity addition

effected by domestic manufacturers. It is

reliably learnt that the combined current

order book position of Indian transformer

manufacturers is around 2.5 lakh MVA. This

is likely to grow exponentially resulting in a

wide demand-supply gap.

China is very well placed to capitalize on the

situation. Thanks to its government

incentives, China is able to produce quality

transformers at low costs. Also the capacity

available with big Chinese players is much

higher than in India. It is learnt that the top

three transformer manufacturers in China

alone have an aggregate capacity of 3.5 lakh

MVA that is many times India's total

installed capacity.

In a very recent development, Tebian

Electric Apparatus Stock Company Ltd

(TEBA), a power transformer maker of

China, announced its plans to set up a large

transformer manufacturing facility in

Gujarat, with an investment of Rs.2,500

crore. TEBA was the first transformer maker

in China to go public. Reliable information

suggests that way back in 2007-08, TEBA

had a manufacturing capacity of around 1

lakh MVA. For a frame of reference, BHEL,

India's largest transformer maker, currently

has an installed capacity of 45,000 MVA.

|

In July this year, the government introduced the Steel &

Steel Products (Quality Control) Second Order, 2011, which

proposes that all CRGO/CRNGO steel used in India should

bear the BIS (Bureau of Indian Standards) certification. This

sincere attempt seeks to ensure that only prime quality CRGO

is used in transformers. India needs 2.5 lakh tonnes of CRGO

every year, and an appalling 70 per cent of this is scrap-grade

material. While conscientious manufacturers try their best to use prime material, they end up using scrap (inferior) material

inadvertently. On the other hand, there are reports of

unscrupulous manufacturers intentionally using scrap CRGO,

producing substandard equipment and then allegedly finding

a market for these low-quality products in connivance with

state power utilities. India is turning out to be a prolific market

for scrap CRGO and there are even reports of importers

turning into transformer manufacturers!

India being a very large and growing market for CRGO,

international suppliers have agreed to have their CRGO

"marked" to comply with the new regulations. Leading

transformer players, in recent interactions with Electrical

Monitor, have pinned their hopes on the timely

implementation of the steel quality control order. This order is

also seen bringing about much needed regularity in the

distribution transformer industry that today has a very liberal

sprinkling of unethical manufacturers.

In a related recent development, public sector entities Steel

Authority of India, Bharat Heavy Electricals and Rashtriya Ispat Nigam have decided to set up a joint venture to

manufacture special-grade steel including CRGO and CRNGO

steel. To be set up with an investment of

3,000 crore, this is

expected to be India's first unit for production of CRGO and

CRNGO steel. The three companies are believed to be in talks

with global suppliers of this technology. In the early 1990s,

Steel Authority of India had made an abortive attempt to

produce CRGO steel at its Bokaro plant in Jharkhand.

Posco of Korea that is building an integrated steel plant in

India has indicated that it could also produce CRGO and

CRNGO steel. It may also be mentioned that UK-based Corus

Steel, which was acquired by Tata Steel in 2007, is amongst the

world's select producers of CRGO steel.

Production of transformers |

(MVA) |

| |

2004-05 |

2005-06 |

2006-07 |

2007-08 |

2008-09 |

2010-11* |

| Power transformers |

60,787 |

62,577 |

77,674 |

94,390 |

119,101 |

148,876 |

| Distribution transformers |

19,369 |

27,181 |

35,181 |

40,412 |

34,272 |

42,840 |

| Total |

80,156 |

89,758 |

112,855 |

134,802 |

153,373 |

191,716 |

| *ERIL estimates |

Testing Facilities: When it comes to testing of high-voltage

equipment such as high-rating power transformers India is

feeling the heat of inadequacies. The growth in testing

infrastructure has not kept pace with that of production - both

quantitatively and qualitatively. Testing infrastructure

available at India's premier agency Central Planning &

Research Institute (CPRI) is proving short of demand.

Manufacturers of large power transformers at times need to

send their equipment for testing in overseas facilities like

KEMA, Netherlands.

Failure rate: One of the embarrassing realities of the Indian

power sector is high failure rate of distribution transformers,

mainly those deployed by state power utilities. Going by

accepted technical standards, distribution transformers are

meant to have an operational life of between 25 and 35 years.

However, transformers are known to be recalled for repair in as

early as three years. The failure rate of distribution

transformers in India is estimated at 10-15 per cent as against

1-2 per cent, even in developing countries.

Problems faced by transformer manufacturers |

The vast and diversity fraternity of domestic

transformer manufacturers is represented

by its apex body Indian Transformer

Manufacturers' Association (ITMA). Although

the association is very upbeat about prospects

of the transformer industry, it has strived to

draw government's attention to the genuine

problems faced by its members. In an exclusive

interaction with Electrical Monitor, ITMA

shared some of the most pressing problems

that transformer manufacturers are coping with.

Much of the woes revolve around procurement

policies and inconsistency in tendering

procedures of government-owned power

utilities-the biggest transformer purchasers.

Here is a gist of the problems faced.

- Different power utilities stipulate different

criteria of sales turnover for registration of

vendors. Due to this, quality-conscious

but small suppliers end up in getting

disqualified. ITMA feels that CVC

guidelines should be followed uniformly,

and fresh entrants should be encouraged

by reserving 20 per cent contract quantity

in their favour.

- Power utilities and discoms tend to specify

minor changes even if the transformer to

be sourced is of BEE-star rating. This leads

to unnecessary type-testing of prototypes

in order to receive star-labeling. ITMA feels

that utilities should uniformly follow one

set of specifications certified by a

competitive body like BEE, for instance.

- Utilities tend to place orders on L1 fully

aware that the price quoted by the lowest

bidder is not viable. This results in

manufacturers resorting to use of inferior

material and hence end up supplying

substandard products. ITMA feels that

utilities should devise realistic

procurement policies and should not

blindly select L1 bidders.

- ITMA also feels that utilities tend to change

technical and commercial specifications

even after opening of the tender. This can

have a big impact on the selected bidder.

ITMA suggests that alteration of terms

should be avoided but if inevitable, utilities

could go in for fresh short-term bids.

- Sometimes utilities stipulate that

manufacturers would be blacklisted if the

equipment fails during testing. This

practice should be stopped and it could

lead to closure of units and stifling

of enterprise.

- ITMA has observed that after transformers

are dispatched, the procurer (power utility)

is sometimes found to carry out tests

unilaterally. False results are reported to

manufacturers and they are debarred for

future orders. ITMA strongly protests

against such unilateral testing and its

adverse consequences on suppliers.

|

This disconcerting failure rate has two aspects - technical

and commercial. The technical reasons are purely those of

overloading. As power demand has outpaced transformation

capacity, old distribution transformers (designed to operate at the then prevailing load conditions) tend to get overworked

and fail.

It is however the commercial aspect of transformer failure

that is more disturbing. State power utilities are bound by the

L1 procurement practice that requires them to purchase

equipment at the lowest quoted bid. Small-scale distribution

transformer manufacturers, with a singular objective of

winning the order, quote an incredulously low figure. The L1

guidelines are objective, leaving no room for subjective matters

like quality. It is learnt that the rates quoted by manufacturers,

in a desperate attempt to win the mandate, are sometimes

much lower than the cost of the bare components. Qualityconscious

manufacturers are known to keep away even from

bidding, making room for more substandard product suppliers

to enter. One reputed transformer manufacturer noted that in

an attempt to comply with L1 guidelines, power utilities end

up incurring much higher lifecycle costs, apart from being

responsible for higher downtimes in the power grid.

All said, BEE's "star labeling" guidelines for distribution

transformers, in force since January 2010, should see a gradual

but significant improvement in the situation.

Power transmission project |

(Cost break-up) |

| Component |

per cent |

| A. Transmission Line |

| Towers |

17.5 |

| Conductors, insulators, etc |

15.0 |

| Construction cost |

17.5 |

| Sub-total (A) |

50.0 |

| B. Substation |

| Transformers |

15.0 |

| Switchgear, breakers, etc |

20.0 |

| Others |

15.0 |

| Sub-total (B) |

50.0 |

| Total (A+B) |

100.0 |

CONCLUSION

India has a challenging road ahead with respect to the

transformer industry. All the same, the country would do well

if it considers this is a big opportunity to reform, grow and

prosper. India has the distinction of producing the world's

largest transformer-and that too through indigenous

technology. On the other hand, we also have the dubious

distinction of a shamefully high rate of distribution

transformer failure that even lesser developed countries could

scoff at. In all power sector-related ambitions, be it power for

all or lower T&D losses, the role of transformers is critical. The

transformer industry has been coping with challenges, many

of which are the creations of a debilitating policy framework

and lack of political will. India has many questions to ask itself:

Despite being a leading steel producer in the world, why is that

India cannot still produce electrical steel? Why do state power

utilities still buy cheap and worthless distribution

transformers just to adhere to archaic L1 procurement

policies? Why haven't state power utilities been able to

standardize technical specifications that can help

manufacturers achieve better economies of scale and reduce

repeated type-testing? Much can and needs to be done in the

transformer industry; on it depends the quality, reach and

reliability of India's future power transmission network.

Untitled Document

Top Transformer Manufacturers |

| Capacity* |

| (MVA) |

| BHEL |

45,000 |

| Crompton Greaves |

27,000 |

| Emco |

20,000 |

| ABB |

17,000 |

| Siemens |

15,000 |

| Areva T&D |

15,000 |

| Bharat Bijlee |

13,280 |

| Voltamp Transformers |

11,000 |

| Indo Tech Transformers |

7,450 |

| *Indicative, as per reliable sources |