As an integral part of

power infrastructure,

cables have an

indispensable role in

reaching power from

generating stations to local

consumption points. This

special story by

Venugopal Pillai, takes a

closer look at two

distinctive features of the

cables industry—the

muddle in the low-voltage

segment and the exciting

opportunities in store for

extra high-voltage cables.

Like any other electrical equipment segment, the

cables industry is very diverse in terms of its product

range and level of quality. The cables industry

covers the entire spectrum from low-voltage

home wiring cables used at the final consumption point

to extra high voltage (EHV) cables used in subtransmission

and distribution lines. The market

segmentation is inverted in that there is a plethora of small

manufacturers at the lower end while the sophisticated

EHV cables category is reserved only for the top-end class

that typically include large domestic and multinational

companies.

The electric cables industry is perhaps the most critical as it

covers, in conjunction with conductors, the entire value

chain from power generation plant to power socket. Apart

from cables used in the power supply chain, specialty cables

are also needed by the industrial sector for use in heavy

machinery, automobiles, consumer goods, etc.

Growth in the cables industry is linked directly to the

investment in the power sector. Further, the fortunes of the low-voltage cables segment are also governed by prospects in

the consumption sectors, mainly domestic and commercial

real estate. To a significant extent, the consumption of

specialty cables also depends on patterns prevailing in the

industrial (manufacturing) sector.

In this special story, we aim to discuss the two ends of the

spectrum. On one, we have the low-voltage building wire

segment that has always been an area of concern; and on the

other is the fast-emerging EHV cables that is today the

biggest business opportunity.

A. LOW-VOLTAGE CABLES

Also referred to as building wires, this is the largest segment

in the electric cables industry, at least in terms of number of

manufacturers and consumers. The estimated market size of

the building wire industry is Rs.10,000 crore with annual

growth pegged at 15 per cent. Unfortunately, this segment is

grossly unregulated with anarchy prevailing rampantly. This

segment is overcrowded with local players that pay no heed

to quality or safety. Players in the unorganized sector are

cognizant of the huge demand potential and can always serve

this growing market, but competing with local players on the

price front is impossible.

The obvious reason why local brands continue to flourish

in the market is that there is a market for it. Consumers are

indeed buying these wires, either inadvertently or willfully.

Products made by a reputed manufacturer could be between

40 to 60 per cent higher than that of a local brand. Products

made by marginal players in the unorganized sector

obviously use inferior material - be it copper or the PVC

insulation. The copper used is not oxygen-free, which results

in poor conductivity. Worse is that the insulation is made

from cheap polymer, which can pose a grave hazard to human

lives, in case of accidental fire. Studies have shown casualties

during a short-circuit induced fire are not because of the fire

per se but due to the toxic fumes emanated during the burning

of the insulation material. Flame retardant cables of the

highest quality are produced only by organized sector players

but they come at a price. Unorganized players simply cannot

afford to produce quality material at prices that they offer.

It is encouraging to note that over the past decade, home

owners and real estate developers are getting increasingly

conscious of the safety element of building wires. Aggressive

awareness campaigns launched by reputed manufacturers

and trade associations are responsible for this change in

mindset. It is estimated that in the four metropolitan and

tier-1 cities, organized sector players have a market share of

90 per cent in the building wire segment. However, when one

moves to tier-II and tier-III cities, this share drops sharply to

30 per cent. At a national level, the share of unorganized

sector players is around 40 per cent.

As discussed above, the highest percolation of unorganized

sector manufacturers is in tier-II and tier-III cities, and of

course the rural markets. In these areas, when electrical wiring is done, the choice of wires is usually left to

electricians and not property owners. Electricians would

compromise on quality because it helps them tender an

"affordable" and "reasonable" estimate to the property

owners. Most importantly, the ill effects of using an inferior

electrical cable are not felt immediately. For the property

owner, the use of an inferior or superior cable makes no visible

difference. It therefore comes as little surprise that electric

cables of superior quality have a market share of only 30 per

cent in semi-urban and rural areas.

Another reason why superior cables are not used in such

areas is the sheer unavailability of these products. Local

producers manufacture and sell within the state and hence

have much lower distribution costs compared to that

incurred by a large manufacturer that has to bring in the

products from outside the state. This economic disadvantage

coupled with the perceived "brand indifference" in non-urban

areas in fact makes reputed manufacturers shun these

markets. An industry source indicated that reputed brands

tend to focus more on urban areas and it is economically

unviable for them to compete with local players. Moreover,

the business margins on 1.1kV electric cable industry are not

very high as compared to higher value-added products like

high voltage and specialty cables.

Sanjay Aggarwal, Chairman & CEO, Paramount

Communications Ltd, in an earlier interaction with Electrical

Monitor, agreed that the Indian consumer market as a whole is

generally low on technical awareness, especially for products

as commoditized as wires. What is recommended by the

dealer or the electrician is generally accepted, and the dealers

and electricians in turn promote those products with which

they get greater financial incentives, rather than on the basis

of safety and quality. Most contractors and builders too are

more concerned with keeping their costs minimal, and they

have a wide array of cheap, low quality brands to choose

from, Aggarwal noted.

It is also worth noting that RGGVY has resulted in a sharp

increase in the number of electrified households,

necessitating building wires and wiring devices. This growth

in the rural demand for electric cables has further spawned

local players in the market. The semi-urban and rural market

will tilt in favour of quality products only with growing

awareness. It is only when the buyer insists on safe and

quality products-and is willing to pay for the quality-will

there be sustainable demand for products by organized sector

players. Currently, the situation is not encouraging but could

improve with time. As of now, an estimated Rs.3,000 crore of

spurious building wires are sold to gullible customers every

year, an industry player noted.

Building wires, especially in the residential segment, is a

"low involvement" product as far as decision-making is

concerned. During home renovation or construction, details

like the colour the paint of the type of switches might get

more attention that a crucial input like electric wires.

Builders might want to willfully compromise on the quality

of wires as an act of cost-cutting, and with a view to

maximizing their profits.

While it must be admitted that India has had a tough time

with the low-end building wire segment, thanks to the

overwhelming presence of the unorganized sector, there is

still some reason to cheer. As mentioned earlier, awareness of

quality cables is on the rise thanks to widespread

promotional activities by large manufacturers and also trade

associations. The share of marginal players in the building

wire segment is likely to plummet in the coming years. In a

recent interaction with Electrical Monitor, R. Ramakrishnan,

CEO, Polycab Group, estimated that in the next three years

the share of unorganized sector players should recede to 25

per cent and settling to 15 per cent in the long term.

The declining share of the unorganized sector would

obviously mean that the market for building wires will be

controlled by reputed manufacturers. This should also result

in big names in the cables industry that have shunned the

building wire business-finding it non-remunerative to

compete with local marginal players wanting to return to it.

In earlier interactions by Electrical Monitor with leading cable

manufacturers, it was learnt that KEI Industries was keen to

scale up production of low-voltage cables, while Lapp India, a multinational specializing in specialty cables, was keen to

enter the building wire segment.

The low-voltage cable industry is admittedly in a mess at

the moment, but the coming years should progressively see

positive change.

PART B: EHV CABLES

EHV or extra high-voltage cables represent an emerging area

of opportunity in the Indian cables industry. EHV cables are

those that are designed to carry very large amount of electric

current, several times higher than high-, medium- or lowvoltage

cables. Although there is no standard definition

available for EHV cables, in the Indian context, cables with a

rating of over 220kV (for alternating current or AC) are

classified as EHV cables. An industry player pointed out that

the classification of EHV cables has evolved over time and

reflects the progress of technology worldwide. Some years

ago, even cables of 132kV rating were considered EHV cables

and earlier, even 66kV cables merited the classification of

EHV.

EHV cables fit perfectly into India's current power scenario

and given the intrinsic value offered by EHV cables, the

market is expected to grow substantially. Extra high voltage

cables are normally used during bulk power transfer, which is

in sub-transmission and distribution lines. EHV is used in

areas where it is difficult or unfeasible to install overhead

power conductors. EHV cables however involve higher initial

costs. They cost more and also their laying, which is done

underground, can be cumbersome. All the same, the life-cycle

cost of EHV cables is strikingly low.

The obvious advantage of underground EHV cables is that

they are invisible and hence there is no physical hindrance

whatsoever. Secondly, EHV cables have very long operating

life and are virtually maintenance free. EHV cables also can

play a very important part in reducing commercial power

losses. Unlike in the case of bare overhead conductors from

which electricity can be tapped (stolen), no power theft is

possible with EHV cables. Also, India's cities are rapidly

expanding. Urbanization in India that stood at 26 per cent in

1991 touched 31 per cent in 2011. By 2020, as reliable

forecasts indicate, around 40 per cent of the country's

population will dwell in urban centres.

Urbanization leads to not only additional load from

existing demand centres, but also the creation of new load

centres. All this warrants augmentation of transmission lines

capacity and even creation of new T&D infrastructure.

These days, securing right-of-way is becoming increasingly

difficult not only in metropolitan and tier-I cities but also in

tier-II and tier-III cities. Power distribution through EHV

cables is becoming the first priority wherever aerial cables are

impossible to install. It must also be noted that power

utilities, with a clear goal of obviating power theft, are

nowadays unconditionally insisting on underground EHV

cables.

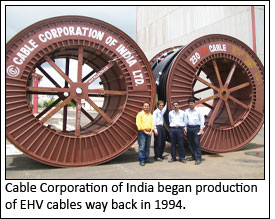

Technology: Local technology for producing EHV cables

(above 220kV) did not exist in India, primarily because there

was no perceived need for such cables. According to

information available with Electrical Monitor, the tilt towards

EHV cables began surfacing in the mid-1990s. In 1994, Cable

Corporation of India Ltd (CCI) produced 220kV cables for

the first time in the country. This was then the highest rating

cable produced in the country and defined a new paradigm.

Till then, cables of 132kV were normally considered to be of

the EHV type. CCI continued upgrading its technology and

began producing 230kV cables. Currently CCI is upgrading

its technical competency to produce 440kV cables.

Foreign players: Over the past five years or so, the Indian

EHV cable segment has seen enormous interest from large

multinational names. Foreign names like Nexans, Prysmian,

LS Cable, Brugg Kabel, etc have identified India's EHV cable

industry as a huge business opportunity. These

multinationals have entered India through strategic joint

ventures with leading Indian names like Polycab, Finolex,

Ravin Cables, etc. Although India permits 100 per cent FDI

for manufacture of cables, most foreign entities have

preferred the joint venture route. The Indian market for HV

and EHV cables though very large is still represented by

government utilities. Marketing and distribution of cables is

therefore a skill that is acquired only by sustained presence in

the industry. It is perhaps with this in mind that strategic JVs

are being formed with the foreign partner bringing in the

technology and the Indian partner providing the local

expertise. Apart from these, there are cases where the foreign

partner will only provide technical expertise without any financial (equity) participation. In all this, there are even

Indian companies that are producing EHV cables without

any formal technical collaboration. There is also at least one

instance where Indian entities are undertaking dealerships to

source and distribute EHV cables manufactured by overseas

companies.

Here is a brief description of emerging entrants in the EHV

cables segment, largely relating to cables exceeding 220kV.

While some companies have begun production, others are in

the process.

Finolex J-Power: In early 2008, Finolex Cables Ltd,

amongst India's largest player in the power and telecom

cables industry, entered into a joint venture agreement with

J-Power Systems Corporation of Japan for setting up a

greenfield manufacturing facility in India for EHV cables up

to 500kV. Named Finolex J-Power Systems Pvt Ltd, the JV

would also undertake "connectorization" of complete circuits

and supply of jointing kits. In September 2011, the greenfield

plant at Shirwal near Pune in Maharashtra was

commissioned. The JV has also started participating in the

tenders invited by government utilities. The copper rods

required in the manufacture of EHV cables are being supplied

by Finolex Cables Ltd, it is learnt. JPower Systems represents

a conglomeration of two Japanese cable giants Hitachi Cable

and Sumitomo Electric Industries.

Polycab-Nexans: In March 2009, global cable

manufacturing company Nexans, headquartered in France

teamed up with Polycab Wires Pvt Ltd to set up a greenfield

manufacturing unit at Vadodara in Gujarat.

However, it is now reliably learnt that Nexans has decided

to pull out of the joint venture following considerable delays

in setting up of the manufacturing plant. In an email

exchange with Electrical Monitor, a Nexans spokesperson

confirmed that the decision to terminate the joint venture in

India was made due to "several issues that could not be solved

in a decent period of time." Elaborating on some of the

reasons, the official cited that the JV faced major difficulties

to get authorizations to build the facility and start

operations. The JV is no longer in force, the official

reaffirmed.

The two partners had planned to invest Rs.400 crore in the

facility to make EHV cables apart from manufacturing and

marketing special cables for the shipbuilding, material

handling, railway and wind power industries. Nexans was to

hold 50 per cent equity capital plus one equity share and was

to manage the joint venture company in close cooperation

with Polycab.

Nexans has commercial operations in India but no

manufacturing facility as yet. The Nexans official further

explained, "Nexans will consider any opportunities that may

arise in the future to develop its operations in India."

KEI-Brugg Kabel: In November 2010, KEI Industries

inaugurated its EHV cable manufacturing plant at

Chopanki in Rajasthan. The unit is currently capable of

producing cables from 66kV to 220kV. The facility was set

up with technical collaboration (without financial

participation) with Brugg Kabel AG of Switzerland, a

global manufacturer of EHV cables, jointing kits and cable

accessories.

Ravin-Prysmian: In February 2010, Ravin Cables Ltd signed a joint venture with The Prysmian Group, Italy, a

global leader in the energy and telecommunications cables

industry for manufacture of all kinds of LV, MV, HV, EHV and

other specialty cables. Prysmian Group will take a 51 per cent

stake in Ravin Cables, with the other 49 per cent stake

remaining in the hands of the current promoters, with Vijay

Karia being the Chairman & Managing Director. Prysmian

manufactures EHV cables up to 500kV at its global

manufacturing facilities.

KEC International: In July 2012, KEC International Ltd

announced that it completed the first phase of its hightension

cable unit at Vadodara. The greenfield unit will

currently produce cables up to 33kV at an annual capacity of

1,800 km. In the second phase, KEC will start producing EHV

cables (up to 220kV) at the Vadodara unit. It will also produce

cables in the 400kV class in a phased manner. On completion

of both phases, the total cable production capacity of the

Vadodara unit will be around 4,000 km per year. It may be

recalled that RPG Cables Ltd, part of the RP Goenka Group,

was merged with KEC International in October 2009.

Cable Corporation of India: As discussed earlier, Cable

Corporation of India (CCI) has been the traditional leader of

EHV cables in India. It began production of 220kV cables way

back in 1994 and subsequently started production of 230kV

cables. CCI does not have a technical collaboration for its

EHV cables. The company recently upgraded its

manufacturing facilities for production of 400kV EHV

cables. Production of 400kV cables has started and testing is

underway.

Diamond Power: Gujarat-based Diamond Power

Infrastructure Ltd, formerly Diamond Cables Ltd, currently

produces India's highest-rating EHV cables. In June 2011,

DPIL set up a modern EHV cable factory at an outlay of Rs.85

crore with technical support from Malliefer of France. The

plant has a capacity to produce EHV cables up to 500kV,

making Diamond Power among the only seven

manufacturers in the world to have such range of extra high

voltage cables.

Shree NM Electricals: Shree NM Electricals, amongst

India's largest distributor of electrical equipment, has tied up

with China-based Chongqing Yuneng Tai Shan Cable & Wire

Company Ltd for supply of EHV cables in India. Chongqing

Yuneng Tai Shan is believed to be the largest manufacturer of

EHV cables in China and markets its cables under the

"Taishan" brand. It produces cables up to 500kV and also

aluminium conductors. Its 500kV cable capacity alone is said

to be 1,000 km per year.

EHV IS THE WAY FORWARD

EHV IS THE WAY FORWARD

The Indian EHV cables market is yet nascent and the

collective indigenous capability to produce cables of above

220kV is still embryonic. The first known instance of

deploying EHV cables exceeding 220kV in India was

somewhere in the mid-1990s. Over the past five years,

reputed domestic players are extending their competency to

cover EHV cables. The demand potential, as universally

agreed, is vast. Transmission and distribution utilities are

showing a marked preference to EHV cables, in cognizance of

their advantages over conventional overhead conductors.

Currently, there are around six Indian companies that are

acquiring the capability of manufacturing EHV cables of

rating 220kV and above. In the coming years, more

companies would enter the fray to capitalize on the business

opportunities. While Indian companies would rely on the

technology available in the developed world, the tie-ups

would not necessarily be financial. As one local cable

manufacturer explained, EHV cable technology is also

available with cable machinery manufacturers. As such, one

need not always go in for financial collaborations with cable

producing companies. Diamond Power Infrastructure, for

instance, entered into an agreement with Malliefer of France,

a reputed machinery manufacturer. Diamond is perhaps the

only Indian company, competent to produce EHV cables

even up to 550kV. Hence, Indian companies could have

technical (non-financial) collaborations with either cable

producing companies or cable machinery manufacturers.

On the other hand, foreign cable producing companies are

only too keen on enter India; they have established timetested

technology but do not have a local market as big as

India's. In European countries, the demand for conventional

EHV cables is drying up and technology is idling.

Multinational cable manufacturers are seen to be more

inclined on equity-backed joint ventures as it gives them

better returns, even in the face of higher risks. As observed

earlier, even through 100 per cent FDI is allowed,

multinationals are keen to tying up with local manufacturers

to ensure that global technology is complemented by local

marketing expertise. The coming years will see a large flow of

foreign technology into the Indian EHV cable market,

including pure technical agreements and financial

collaborations.The EHV cable market potential during the

past five years was around 300 km per year and during the

current fiscal year ending March 2013, this is expected to

reach 500 km. Experts believe that widespread investment in

the power T&D sector will lead to EHV cables recording a

growth of even 25 per cent per year in the medium term. Over

the next five years, the annual Indian EHV market could well

be in the region of 1,500-2,000 km.

EHV cables is clearly the next big story, and most likely the

next growth story,in India's power cable market.