Sushilkumar Shinde, Union power minister, appeared to

be very pleased with the performance of his ministry

during the past five to six years, but accepted that "we

have a long way to go." India's per capita power consumption

is currently 800 kwh per year, which is around one-tenth of

that in developed countries. While Shinde issued laudatory

remarks on the way the power generation capacity has

performed, he was wary and even critical of the power

distribution sector. "Distribution losses have to be seriously

looked into," was just one of the several observations he made

on this crucial last-mile segment in the power value chain.

On the generation front, the minister was more than happy

to note that the country was going to add 51,000 mw of new

power generation capacity from conventional sources alone,

during the XI Plan period. This is over and above 14,000 mw of

new capacity from renewable energy sources and 12,000 mw

from captive power plants. During FY11 alone, he asserted,

the country could add as much as 12,000 mw of new capacity.

"There was a time when the country could add only 8,000 mw

to 10,000 mw in an entire five-year Plan period," he noted with

satisfaction. He also observed that over 80,000 mw of new

power generation capacity was currently under construction.

With respect to power generation capacity, the role of

private sector has been exemplary. In the X Plan period (2002-

07), private sector had a share of 10 per cent in new power

generation capacity added. This is expected to grow to 32 per

cent in XI Plan period and further to 52 per cent in the XII Plan

period (2012-17), Shinde observed. While power generation

capacity is increasing at a satisfactory pace, the shortage of

subcontractors and manpower for maintenance works,

remain as areas of concern. Shortage of balance-of-plant

contractors for thermal power plants was a very serious issue,

he noted.

Untitled Document

Coal, gas and environment |

| While Shinde repeatedly noted that power generation capacity

has grown as a very healthy rate, he expressed concern that fuel

supplies-coal and gas-have not kept pace. "Coal and gas are not

matching us (power sector)," he asserted. Shinde sought firm

coal linkages for power projects and cautioned that if linkages

were not in place, financing of new projects was in peril. For

completed coal-fired plants, the minister said that he was keen

that firm fuel supply agreements (FSA) are signed. Delays in

environmental clearances are causing hardships on many frontsnot

just for new power generation projects but also exploration of

new coal mines. Domestic coal production has fallen

considerably short of targets, government statistics indicate. |

COMPETITIVENESS & COMPETITION

Shinde stressed on the need of building capacity in the BTG

segment, asserting that India's development hinges on

growth of its power sector. He was pleased that India was

now in a position to export main plant equipment, a situation

that was quite unthinkable say five to seven years ago. While

domestic mainstay Bharat Heavy Electricals Ltd is ramping up

its manufacturing capacity from 5,000 mw to 20,000 mw per

year, there are several entities (joint ventures between Indian

and multinationals) that are setting up manufacturing

facilities in the country for supercritical BTG equipment.

Admitting that there is a threat from imports, he assured

domestic companies of government support. "You are bound

to get our protection," Shinde said.

In his address, Ramesh D. Chandak, President, IEEMA,

observed that India's investment in power T&D is lacking.

While in developed countries, investment in T&D is one and a

half times that in generation, in India the ratio was barely 1:1.

Chandak noted that though T&D players have contemporary

technology and have established themselves globally, the

built-up capacity stands under utilized across several

products, as there has been a surge in imports. Requesting the

government to create a level-playing field for domestic

manufacturers, Chandak noted, "Domestic electrical

equipment manufacturing industry is at a substantial

disadvantage vis-à-vis imports, which is impacting the

commercial viability of the industry and would have long

term consequences."

The "level-playing field" requirement in the context of

imports was echoed by several manufacturers during the

interactions that Electrical Monitor had with exhibitors at

Elecrama 2012. Several domestic transformers manufactures

said that they were not concerned with Chinese players

establishing manufacturing base in India, but were

apprehensive of cheap imports from China. The Chinese

government supports exports through fiscal benefits

resulting in lower landed costs in India. This hurts domestic

suppliers. However, if Chinese companies set up shop in India,

they will be at par with Indian counterparts. "We have no

problems with a Chinese company setting up a

manufacturing plant in India and competing with us

(domestic manufacturers). We welcome such fair

competition," a Hyderabad-based transformer maker told

Electrical Monitor.

While Shinde abundantly assured protection to domestic

companies from cheap imports, he was also sympathetic to

the criticality of imported BTG equipment in meeting

India's XI Plan targets. While there is a possibility of the government levying countervailing duty on imported

equipment, to protect domestic manufacturers like BHEL,

Larsen & Toubro, and the several JVs coming up, there could

be a duty exemption on equipment already ordered by

private power producers for commissioning in the XI Plan

period. "We have to protect those power producers that have

placed orders on foreign suppliers in the XI Plan," the

minister said.

In his note on Industry Day, B. P. Rao, CMD, Bharat Heavy

Electricals Ltd made very interesting observations on Indian

competitiveness and the true challenges that the Indian

power equipment industry faces. He noted that it was time

India moved away from cost-led competitiveness to

innovation-led competition. "Competition is still on the

basis of low-cost of production. We have still to move to the

plane of competition based on innovation," Rao observed.

Citing the example of his own company, the CMD said that

BHEL now spends 2.5 per cent of its sales on R&D, which is

amongst the highest in the industry. The public sector

engineering company is also filing patents at the rate of

almost one per day. Yet, as Rao admitted, it was way below

the standards of global giants.

Untitled Document

Limit on UMPP developers |

While responding to a question on the broad status of ultra

mega power projects, Union power minister Sushilkumar

Shinde expressed satisfaction at the government's initiative

of launching ultra mega power projects. He said that the endeavour

had even won the appreciation of the international community. From

2006 onwards, four UMPPs have been awarded and this was a

commendable performance, the minister felt. When asked about his

view on the fact that out of the four UMPPs, three have gone to the

same developer, he said that the government has now decided to limit

the number of UMPPs to be awarded to a single developer to three.

This could imply that Reliance Power (Anil Ambani Group) would not

be eligible to bid for more UMPPs. Reliance has won three UMPPs—

Sasan, Krishnapatnam and Tilaiya—while the Mundra UMPP has

gone Tata Power's way. The minister also noted that progress on the

UMPPs in Orissa and Chhattisgarh was hampered by environmental

clearances. However, with the recent clearance to the Orissa project,

there should be forward movement in the near future, he felt.

On the question of the financial viability given the increase in

prices of imported coal, Shinde said that talks were on with

ambassadors of coal-exporting countries like Indonesia. "We will do

our best to resolve the issue," was what he had to say. It may be

mentioned that Indonesia recently decided to export coal only at

market-related prices thereby affecting the financial viability of

UMPPs. Developers of the coastal Krishnapatnam and Mundra

projects had contracted to buy coal at much lower rates, backed by

long-term purchase agreements. The increase in coal prices could

very much affect the tariffs quoted by the developers whilst wining

the projects. Increase in coal prices could put a big question mark on

the financial viability of the UMPPs, especially those designed to run

on imported fuel.

|

On China too, Rao made some profound observations. He

explained that China's so-called dominance was not the result

of innovation but on that country's ability to create a local

value chain. Having the complete production value chain has

brought down China's cost of production to globally competitive

levels.

Back home, there were many challenges on the power

equipment production front. Rao said that the industry was

still dependent on key imported material like CRGO steel,

large diameter piping, HVDC insulation material, etc. "It puts

industry at a disadvantage not just with respect to costs but

also lead time." Rao pointed out that India's domestic power

generation capacity is expected to nearly double from the

current 1.86 lakh mw, by 2017. This would need concerted

effort on the part of all stakeholders. Apart from import

dependence, India also faced challenges in terms of infrastructure inadequacies. Slow ODC movement, due to

infrastructure (logistics) bottlenecks, results in higher cycle

time, he said. He also dwelt on lack of domestic testing

facilities due to which high-voltage equipment needs to be

sent overseas for testing, resulting in higher lead times.

On the subject of competitiveness, Rao exhorted industry

players to become global names. "The industry is largely

driven by local demand. We have failed to make a mark in the

global market." On the much-debated topic of government

support to the industry, Rao assured, "Industry has clarified

several times. We don't need support; we need a level-playing

field. We want protection from taxes, not from competition!"

S. Sundaresan, Secretary, Union Ministry of Heavy

Industries also admitted that Indian manufacturers need to

benchmark their products on global standards. He noted that

the equipment manufacturing sector faces several challenges

like dependence on imports for crucial raw material, shortage

of manpower, low R&D expenditure, lack of planning,

skewed procurement policies, etc. In this brief keynote

address, Sundaresan noted that the "Brand India" endeavour

has not received the desired policy attention.

Untitled Document

National Electricity Fund |

The Union government has recently approved the National

Electricity Fund with a view to encourage reforms-based

progress at the state government-level. NEF will be initially taken

up for two years on pilot basis. This programme will be a reformsbased

initiative where eligibility for entry (access to assistance

under NEF) will be determined by the reforms-related performance

of state power distribution utilities. Benefits in terms of interest

subsidies will be available to participating utilities on the basis of

achieving further parameters of reforms, mainly reduction in ATC

losses. In the first two years, utilities would borrow Rs.25,000

crore from FIs and banks, and they will help in strengthening the

distribution system and closing the gaps between achievement

and target under flagship programmes like R-APDRP and RGGVY. |

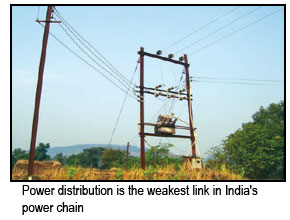

DISTRIBUTION IS THE WEAK LINK

Sushilkumar Shinde noted at regular intervals in his keynote

address and press briefing that the power distribution sector

was in poor state. "Distribution is the most critical element of

electricity but has been widely ignored. The heart of the

power sector lies in efficient management of the distribution

sector," he explained.

The minister appeared worried about the high ATC

(aggregate technical and commercial) losses. Though such

losses have come down from about 39 per cent in FY02 to 27

per cent in FY10, the government would ideally like them to

be lower than 15 per cent. "We are not happy," he said, adding

that even foreign investors are appalled at the state of India's

power distribution sector. While measures under the RAPDRP

project as also modern technology is expected to bring

down ATC losses, the efforts need to be redoubled.

Shinde also elaborated on the government's intention of

firstly understanding the nature of these ATC losses. Various

industry and government reports have placed combined

losses of state-owned power utilities between Rs.50,000 crore

to Rs.80,000 crore. "These losses need to be understood," the

minister noted. To this effect, the power ministry is planning

to appoint an independent (non-government) investigator to

know the break-up of these losses-commercial losses,

technical losses, power theft, free power, etc. On the subject

of free power, the minister accepted that while the Electricity

Act, 2003 does have a provision for free power, utilities are not

exercising discretion. Utilities need to make budgetary

provisions for such free power, a practice not fully adhered to

currently, he noted.

Shinde also pointed out to mismanaged practices by power

utilities with respect to tariffs. Increasing of power tariffs, as

also envisaged by the Electricity Act, 2003, needs to be an

"automatic" process. Several power utilities have not

increased tariffs for as many as seven years and when they did,

there was immense resistance from consumers. Such

situations can be avoided. Meanwhile, it is reliably learnt that

state electricity regulatory commissions are expected to

penalize distribution companies that fail to annually revise

tariffs. Shinde also appreciated that some utilities have

started increasing tariffs even at six-monthly intervals. "I

think this is a good sign," he observed.

Shinde was also appreciative of private sector enterprise in

power distribution, noting the smart turnaround in erstwhile

loss-making circles like Bhiwandi (Maharashtra), Agra,

Kanpur (both UP), etc. The ATC losses in many privatized

circles have reduced to single-digit levels. Even due to

measures envisaged under R-APRDP, ATC losses in over 200

populous towns have come down to as low as 5 per cent,

Shinde commented.

In his keynote address, Devendra Singh, Joint Secretary-

Distribution, Ministry of Power, admitted that the power

distribution sector was not in the best of health with

cumulative losses exceeding Rs.1 lakh crore. There are gaps

between recovery and cost of supply, and the losses are well in

the high double-digit range.

CRITICAL PHASE FOR TRANSMISSION

R.N. Nayak, CMD, Power Grid Corporation of India made

very emphatic statements about the power sector, suggesting

that the critical growth phase will be from 2012 onwards.

Over the past five years, the power sector has seen drastic

changes. Prognosticating on the XII Plan period and onwards,

Nayak said that supercritical technology will be the norm for

coal-fired power plants and that 400kV transmission lines,

considered as EHV lines currently, will be treated nothing

more than "sub-transmission" infrastructure.

Transmission networks will need to be augmented rapidly

given the growth in electricity load in urban areas. Some

cities, as Nayak observed, have seen a load growth of 15 per

cent, which is phenomenal compared to that seen in even

developed countries. He explained that with India's per capita

consumption still very low, such high growth in power

consumption would be but obvious.

Nayak said that by March 2012, at least 1,000 km of 800kV

AC lines and around six 765kV substations would be set up.

PGCIL currently has 90,000 ckm of transmission lines in the

country's total of some 2.5 lakh ckm. The PGCIL chairman

also noted that construction of India's first 800kV DC line has

started and completion is expected over the next 30 months.

Among other achievements, Nayak highlighted India's

movement to 1,200kV UHVAC power transmission

infrastructure (See Box) and also PGCIL's involvement in the

Smart Grid project.

Untitled Document

POWR OUTLAY: XII PLAN |

| |

1.8 |

| Generation |

6.0 |

| Transmission |

1.8 |

| Distribution |

5.0 |

| Total |

12.8 |

With power transmission infrastructure getting more

intricate, conventional methods and thinking might not work. He citied the example of maintenance of transmission

towers that is now being done with the help of helicopters. In

the near future, PGCIL will be inviting international bids for

helicopter-based maintenance of its transmission network.

He also alluded to the strong possibility of remote

maintenance of EHV substations, without human

intervention. Nayak explained that substations will be

monitored remotely through online systems. Except for

physical security, there will be no human intervention in

substation maintenance. In the next 18 months, PGCIL

expects that most of its EHV substations will be remotely

maintained. On another note, PGCIL also expects to

commission two mobile substations of 315MVA/400kV. This

will help in quick replacement of substations needing repair.

On PGCIL's investment in the XII Plan period, Nayak said

that the Central transmission utility expects to see an

investment of $28-30 billion over the next 5-6 years. PGCIL

expects to add another 70,000 ckm to its existing

transmission network of 90,000 ckm, by March 2017. At

least 80 more EHV substations will be built, growing from

the 145 existing currently.

OUTLOOK FOR XII PLAN

P. Uma Shankar, Secretary, Ministry of Power, summarized

the performance of the power sector in the XI Plan and

charted possible courses of action for the ensuing Plan period.

In the XII Plan period (2012-17), India is expected to add

76,000 mw of new power generation capacity as compared

with around 52,000 mw in this Plan period. Further, over 50

per cent of the incremental power generation capacity in the

XII Plan period will be from the private sector. Uma Shankar

also observed that over 40 per cent of India's new power

generation capacity in the XII Plan period will be based on

supercritical technology.

In the transmission sector, 69,000 ckm of 220kV lines are

expected to be added, which is broadly in tune with the target.

In the XII Plan, the addition is targeted to be 1 lakh ckm. In

terms of inter-regional transfer capacity (IRTC), the

cumulative achievement up to March 2012 will be twice the

level of March 2007. In the XII Plan, 58,000 mw of new IRTC

is being planned that would once again double the

outstanding level between March 2012 and March 2017.

The investment in power generation in the XII Plan is likely

to be Rs.6 trillion, followed by transmission with Rs.1.80

trillion and distribution with Rs.5 trillion. This, as many

industry experts point out, will be the first time that

investment in T&D will surpass that of generation.

The power secretary also pointed out that flagship schemes

like R-APDRP and RGGVY will continue in the XII Plan

period. RGGVY, which is currently at the village-level, will be

taken to the habitation level during the next Plan period. RAPDRP

will see a lowering of its threshold limits thereby

extending itself to many more towns, the Secretary noted.

Uma Shankar highlighted the growing contribution of

renewable energy capacity. In the XII Plan, around 13,000 mw

of new renewable capacity is expected, to be followed by

30,000 mw in the XIII Plan. To support the 43,000 mw of such

capacity over the next decade, the power ministry has

planned to strengthen the inter-state transmission network,

particularly with respect to renewable energy-rich states like

Tamil Nadu, Punjab, Maharashtra, etc. Financing the

proposed inter-state transmission system will be supported

through measures like capital subsidy and viability gap

funding (VGF) mechanism.

In all the deliberations at Elecrama 2012, it came out very

strikingly that the XII Plan period will define a paradigm shift

in India's power sector. Across all parameters—policy

framework, reforms process, physical performance and

building local competencies—the XII Plan has much in store.

India has done reasonably well—if not exceedingly well—in

the XI Plan period and the ensuring Plan period will hopefuly

be an improved furtherance of the current effort.

Untitled Document

India moves to 1,200kV |

India will soon have the rare distinction of having the highestrating

power transmission system in the world. On January 27,

2012, PGCIL was set to inaugurate the 1,200kV UHVAC test

station at Bina in Madhya Pradesh. In his address, R. N. Nayak,

CMD, PGCIL was very appreciative of the effort and lauded

domestic suppliers to have contributed to this landmark

development. Nayak reminisced that when 1,200kV infrastructure

was conceived in 2006, it was never expected that it could be

done entirely through indigenous technology. However, he noted

that the entire gamut of equipment, from clamps and connectors

to power transformers,was supplied by Indian manufactures.

Nayak also observed that some companies supplied equipment

without any financial charge, treating it as contribution for a

national objective. |