Wind energy will continue

to the backbone of India's

renewable energy pursuits.

With an average net wind

power capacity addition of

1.7 GW per year over the

past five years, the focus

on wind energy appears to

be getting only sharper. A

key enabler to India's wind

energy pursuits will be a

sound manufacturing base

for towers, turbines and

related components. This

special study by

Venugopal

Pillai brings you closer to

recent developments in the

Indian wind power

equipment industry, and

attempts to present the key

challenges in store.

The wind turbine industry in India is fast evolving as it

gears up to meet the huge growth in wind energy

installations. In recent times there has been

significant interest in global wind turbine manufacturers

setting up shop in India, some on their own and others in

collaboration with Indian partners. There is also an

upcoming breed of domestic companies that are raring to go

solo in the manufacture of low-rating wind turbines.

Average size of WTG installations |

(kW) |

|

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

| China |

771 |

897 |

931 |

1,079 |

1,220 |

1,360 |

| Denmark |

2,225 |

1,381 |

1,875 |

850 |

2,277 |

2,368 |

| Germany |

1,715 |

1,634 |

1,848 |

1,879 |

1,916 |

1,977 |

| India |

767 |

780 |

926 |

986 |

999 |

1,117 |

| Spain |

1,123 |

1,105 |

1,469 |

1,648 |

1,837 |

1,897 |

| Sweden |

1,336 |

1,126 |

1,138 |

1,670 |

1,738 |

1,974 |

| UK |

1,695 |

2,172 |

1,953 |

2,049 |

2,256 |

2,251 |

| USA |

1,309 |

1,466 |

1,466 |

1,669 |

1,677 |

1,731 |

| Source: GWEC |

It is estimated that the total annual capacity of WTG (wind

turbine generators) in India is currently anywhere between

3,000 mw and 4,000 mw. Precise numbers are difficult as

several players are new and production has yet to stabilize. It is

encouraging to note that over the next 2-3 years, India's WTG

manufacturing capacity could be augmented by at least 1,000

mw, given the ambitious plans of existing and new players.

The Indian manufacturing base is projected to serve both

the domestic and international markets. According to

Indian government estimates, exports of indigenously made

wind turbine generators amounted to $600 million

(around

2,800 crore) during 2009-10, destined to countries

like Australia, China, Brazil, USA, Portugal and Spain.

Exports of WTG components and blades were valued at

another $6 million in that year.

Currently, there are around 20 manufacturers that make

turbines of 250kW or higher. There are of course small local

manufacturers that make turbines of lower rating but their

market share is declining as such equipment is fast getting

obsolete. Wind turbine installations in India are currently of

600KW or higher.

The WTG manufacturing base in India is quite sound with

practically all leading global names like Enercon, Vestas,

Siemens, Vensys, AMSC, Gamesa, etc already present in the

subcontinent. In fact, domestic company Sulzon is amongst

the global wind energy giants, both as an equipment

manufacturer and power producer.

IFC makes first exposure to

Indian WTG industry |

International Finance Corporation, part of

the World Bank Group, recently made its

first investment in an Indian wind turbine

manufacturer. IFC has decided to provide

€11 million loan to Gamesa Wind Turbines

Pvt Ltd that is building a wind turbine

assembly unit in Chennai, Tamil Nadu.

IFC's loan will support Gamesa's plans to

scale up its assembly capacity in India over the next two years.

"Our project with Gamesa represents IFC's first investment in a

wind-turbine manufacturer in India, and we are committed to

supporting energy generation from renewable sources to reduce

greenhouse-gas emissions," said Sergio Pimenta, IFC Director

for Manufacturing in Asia. "The investment will help address

India's energy deficit and sustain its forecasted trajectory of

economic growth," he added. International Finance Corporation, part of

the World Bank Group, recently made its

first investment in an Indian wind turbine

manufacturer. IFC has decided to provide

€11 million loan to Gamesa Wind Turbines

Pvt Ltd that is building a wind turbine

assembly unit in Chennai, Tamil Nadu.

IFC's loan will support Gamesa's plans to

scale up its assembly capacity in India over the next two years.

"Our project with Gamesa represents IFC's first investment in a

wind-turbine manufacturer in India, and we are committed to

supporting energy generation from renewable sources to reduce

greenhouse-gas emissions," said Sergio Pimenta, IFC Director

for Manufacturing in Asia. "The investment will help address

India's energy deficit and sustain its forecasted trajectory of

economic growth," he added.

With 11 GW of installed wind capacity, India is the

fifth-largest wind market in world. Since 2005, the country has

seen a steady increase in installations, a statement by IFC noted.

|

Over the past year, there has been a spurt in the plans of

multinationals planning to set up manufacturing facilities for

WTGs. It is not only about growth in the number of players, it

is more about the elevation in technology standards. For

instance, the average size of WTG installations, measure in

terms of turbine capacity is poised to increase substantially

from the current 1.12 mw (see table). India might soon have

direct-drive turbines that can harness electrical energy even

from low-velocity winds.

The following is a summary, over the past one year or so,

of prominent names that have announced their plans of

entering or furthering their presence in the Indian WTG and

components market.

Siemens:

Siemens: This German engineering giant recently

announced plans of producing its SWT-2.3-113 (Direct

Drive) wind turbine in India. This 2.3-mw WTG with a

direct drive is specially designed for low-velocity

conditions. Siemens will manufacture this and other

turbines at Vadodara, Gujarat. The production at Vadodara

is slated to commence in 2013 with an annual capacity of

250 mw which will be scaled up to 500 mw by 2015 to meet

market demand. The company is additionally investing in

an R&D technology center at Vadodara. Late last year,

Siemens announced its plans of entering the renewable

energy business in India. Apart from wind energy, Siemens

will also pursue opportunities in solar power equipment.

Kenersys: Kenersys India, part of the Kalyani (Bharat

Forge) Group, very recently launched its new K100 2.5-mw

turbine. Equipped with Kenersys' "Synerdrive" technology,

the turbine will be manufactured at the newly-inaugurated

Baramati plant in Maharashtra. The turbine was launched

in the global market in 2007 and is being used by Vattenfall,

considered as amongst the largest wind power utility

globally. The Baramati plant is set up over an area of 35 acres

and a built up area of 5,600 sqm. Apart from the K100

turbine, the production facility will also manufacture the

K82 2.2-mw turbine.

WTG Manufacturers in India* |

Company |

WTG Ratings |

(KW) |

| Elecon Engineering |

600 |

| Enercon India |

800 |

| Essar Wind |

1500 |

| Emergya Wind Technologies |

750, 900, 2000 |

| Gamesa |

850, 2000 |

| GE Wind |

1500, 1600 |

| Ghodawat Energy |

1650 |

| Global Wind Power |

750, 2500 |

| Inox Wind |

2000 |

| Kenersys India |

2000 |

| Leitner-Shriram |

1350, 1500 |

| Pioneer Wincon |

750 |

| ReGen Powertech |

1500 |

| RRB Energy |

600, 1800 |

| RK Wind |

600 |

| Siemens |

2300 |

| Suzlon |

600, 1250, 1500, 2100 |

| Vestas India |

1650, 1800 |

| WinWinD |

1000 |

| Xyron Technologies |

1000 |

| *List is not exhaustive; excludes makers of low-rating WTGs |

| Source: GWEC |

Gamesa: In March this year, Gamesa, the Spanish wind

energy company announced that it would invest in a new

blade and nacelle factory and a tower factory (in joint venture)

in India. It also launched its R&D Centre at Sholinganallur in

Chennai. Gamesa had launched its operations in India in

February 2010 with setting up of an Indian subsidiary, Gamesa

Wind Turbines Pvt Ltd. The Indian venture of Gamesa has

notched up an impressive turnover of about

1,000 crore in its

first year in India and has exciting plans for the coming years.

Gamesa India is pioneering the Re-Powering initiative which

aims at using the existing wind energy resources on site more

efficiently, with technically advanced and high performance

turbines. (Re-powering is discussed separately in this story.)

Powergear & Gestamp JV:

Powergear & Gestamp JV: In March this year, Chennaibased

Powergear Ltd formed a 60:40 joint venture with

Gestamp of Spain. The joint venture will invest

150 crore

to set up a facility for the manufacture of wind towers. The

plant of Gestamp Powergear Windsteel is coming up on 20

acres in the Sri City industrial estate, some 60 km north of

Chennai. Gestamp is a €5 billion company that is into a

variety of businesses, but mainly in the supply of cut and

pressed sheet metal forms to the automotive industry.

Powergear is a

140-crore company that makes electrical

equipment, such as busducts, and has among its customers,

big names such as GE, Mitsubishi Electric, Siemens, ABB

and Alstom. The upcoming plant at Sri City, expected to be

operational by December, can produce 400 towers a year,

with an estimated market value of

500 crore.

RRB Energy: RRB Energy has planned to start

manufacture of 1.8-mw capacity wind turbines. The

company is also in the process of expanding its range of

blades required for WTGs with the inclusion of the 13m

length blade for the 225KW turbine, in its existing

portfolio. The company's second phase of expansion at its

existing manufacturing site at Poonamallee, Chennai is in

an advanced stage of completion. This expansion involves

an investment outlay of around

100 crore, which is likely

to be completed this year. On completion, the company

expects to achieve an overall production capacity of 700

mw during FY12.

RE-POWERING

RE-POWERING

The gradual increase in India's WTG capacity is explained by

the huge wind power potential that the country is endowed

with. Official estimates suggest that India's gross wind power

potential is an astounding 45 GW of which only 13.065 GW

was harnessed as of end-December 2010. Hence around 70 per cent of the potential yet remains untapped. Over the past 5-7

years, the average annual addition of new wind power

capacity has been in the range of 1.3 GW to 2.2 GW. However

in the years to come, the average annual growth in capacity is

likely to be much more and this would warrant the need for

matching WTG manufacturing capacity.

Leading Wind Energy Nations |

Rank |

Country |

Capacity*

(MW) |

%

chg |

%

share |

| 1 |

China |

44,733 |

73.4 |

22.7 |

| 2 |

USA |

40,180 |

14.5 |

20.4 |

| 3 |

Germany |

27,214 |

5.6 |

13.8 |

| 4 |

Spain |

20,676 |

7.9 |

10.5 |

| 5 |

India |

13,065 |

19.6 |

6.6 |

| 6 |

Italy |

5,797 |

19.6 |

2.9 |

| 7 |

France |

5,660 |

23.7 |

2.9 |

| 8 |

UK |

5,204 |

22.6 |

2.6 |

| 9 |

Canada |

4,009 |

20.8 |

2.0 |

| 10 |

Portugal |

3,898 |

10.3 |

2.0 |

| 11 |

Denmark |

3,752 |

8.3 |

1.9 |

| 12 |

Japan |

2,304 |

10.5 |

1.2 |

| 13 |

Netherlands |

2,237 |

1.0 |

1.1 |

| 14 |

Sweden |

2,163 |

38.7 |

1.1 |

| 15 |

Australia |

1,880 |

9.8 |

1.0 |

| |

Grand Total |

197,039 |

24.0 |

100.0 |

*Capacity and % share as of December 2010

% chg is with respect to December 2009 |

One of the most interesting aspects of wind energy

development has been the evolving phenomenon of "repowering".

Most of India's wind power capacity during the

early years of development was through low-rating

turbines of 500 kW or lower. This was in keeping with the

technology available then. It is estimated that 46 per cent of

the total WTGs installed in India, as of March 2010, were of

500 kW or lower. The aggregate capacity of these turbines,

estimated at 2,331 mw, was around 18 per of the total

capacity as of given date.

Secondly, developers built wind farms for the sake of tax

concessions. Hence, in the minds of the developer, the

efficiency of the installation reduced to secondary importance.

It is also felt that India's gross assessed wind power potential of

45 GW was made under the assumption of low-rating turbines

(those of height up to 60m). Matters are very different now,

and experts feel that India's wind power potential, if assessed

now, could be even twice of the said figure.

Advancement in technology has led to a phenomenon of "repowering",

which means that old low-rating turbines are being replaced by high-rating turbines. Re-powering offers the

unrivalled advantage of increasing the installed capacity of a

wind farm without any expansion in geographical footprint

and, in many cases, without much change to the associated

power transmission infrastructure.

Global Wind Energy Council (GWEC) has estimated that

as of March 2009, Tamil Nadu had the highest re-powering

potential of 800 mw followed by states like Gujarat,

Maharashtra, Andhra Pradesh and Karnataka. Although repowering

is a strong technical possibility, there could be

some difficulties in its execution, GWEC feels. Firstly, repowering

could lead to a reduction in number of turbines

since there will not always be a "one-for-one" replacement.

The issue of ownership needs to be dealt with carefully,

more so if the land has multiple owners. Power utilities that

have signed long-term power purchase agreements may not

be interested in revising the agreements. De-commissioning

of the old turbines and their disposal would involve a cost

that needs to be assessed carefully, GWEC feels. The most

important aspect here is that there is currently no

government policy for re-powering of old wind turbines. A

suitable policy addressing all the aforementioned issues

could expedite the re-powering endeavour.

CHALLENGES

CHALLENGES

As earlier discussed, wind energy will make the biggest

contribution to India's renewable pursuits. In the ongoing XI

Plan period, a total of 24,000 mw of renewable energy capacity

is targeted for addition. Out of this, wind energy is expected to

contribute 10,500 mw representing 75 per cent of the target.

Going by the performance so far, wind energy is expected to

even exceed its target. From an average of 2 GW of new

capacity additions per year now, wind energy is likely to

contribute over 3 GW in the coming years. Thus, creation of

domestic manufacturing capacity is inevitable. Besides, India

is also being seen as a hub to export sophisticated turbines to

the developed markets.

While India is fast magnetizing private capital in wind

turbine industry, inasmuch as it is doing in the area of wind

power development, there are challenges that must be met.

Some challenges are inherent to the manufacture of

equipment while others relate to supply chain management

and logistics-related issues that could impinge on the pace

of wind power capacity creation.

With respect to manufacturing of equipment, there are

concerns in the form of very volatile and rising prices of key

inputs-steel and copper. The domestic market has limited

availability of specialized material like cold-rolled steel and

high-tensile structural steel, industry experts say. This

Installation of high-rating turbines warrants the need for heavy-duty cranes results in heavy dependence on imports. The Indian foundry industry also needs to modernize to facilitate the casting of

heavy and large components related to megawatt-sized

turbines, experts feel. Wind turbine manufacturing is a

fabrication-oriented industry. While India has adequate

vendors for fabrication of steel components, there are issues

regarding timely delivery and consistency in quality. Experts

also suggest that India currently has limited number of

manufacturers of precision components like gearboxes,

bearings and brakes. Growth in domestic capacity in these

critical areas could prove beneficial to the industry.

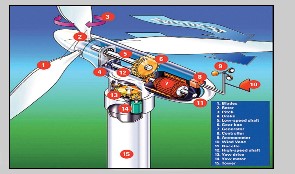

Wind turbine components |

Acomplete wind turbine has the following components: blades,

controller, gearbox, generator, nacelle, rotor and tower. Most

turbines have three blades, although there are two-blade turbine

models. Blades are generally 30m to 50m in length, with the most

common size being 40m. There is a controller in the nacelle and

one at the base of the turbine. The controller monitors the

condition of the turbine and monitors the movement. Many

turbines have a gearbox that enhances the rotational speed of the

shaft. A low-speed shaft feeds into the gearbox and a high-speed

shaft feeds out from the gearbox into the generator. Some turbines

use direct-drive generators that can produce electricity at lower

speeds. Such turbines do not need a gearbox. A generator

converts mechanical energy produced by the rotation of the

turbine into electrical energy. The nacelle houses the main

components of the wind turbine such as the controller, generator,

gearbox and shafts. The rotor includes all the blades and the hub

(that part to which the blades are attached). Towers are strong steel

tubes, usually 60m to 80m in height, on which the nacelle and

rotor stand. Some towers have two or three sections to facilitate

transportation and installation. |

Serious challenges also exist in execution of wind power

projects. This can adversely affect the capacity utilization of

the domestic WTG industry. Amongst the biggest

challenges that wind power projects face is inadequate

logistics support and paucity of construction equipment.

Experts maintain that even if India's wind power potential is

to the tune of 45 GW, its realization depends on the ease and

pace at which projects can be executed. In this respect, some

potential will continue to remain "technical" in nature. In

the coming years, India will see widespread deployment of

multi-megawatt turbines, even those up to 2.5-mw.

Transportation of such heavy equipment to project sites can

be quite a challenge. The assembly for a single turbine could

be up to 60 tonnes, creating complexities in logistics. It is

even learnt that there are not many crane suppliers for super heavy

lifts causing a demand-supply mismatch resulting in

an inordinately high pricing regime.

CHINESE SWEEP

CHINESE SWEEP

Till around four years ago, China was nowhere in the

reckoning when it came to wind power. Today, China has the

largest installed wind power capacity in the world, upsetting

the positions of erstwhile leaders like USA, Germany, Spain

and even India. Let us take a close look at the numbers. As of

December 2010, China had 44.7 GW of wind power

installations, accounting for over a fifth of the global capacity.

Over 95 per cent of China's present wind power capacity was

added in the last four years alone. In 2010 (January to

December), the country added as much as 18.9 GW of new

capacity—comparable to what the rest of the world did

collectively during the period. By 2015, experts feel that

China's total wind power installations could cross 129 GW,

which means an annual growth of over 22 per cent.

World's leading WTG companies |

Company |

Headquarters |

Market share (%) |

| Vestas |

Denmark |

12 |

| Sinovel |

China |

11 |

| GE |

USA |

10 |

| Goldwind |

China |

10 |

| Enercon |

Germany |

7 |

| Gamesa |

Spain |

7 |

| Donfang DEC |

China |

7 |

| Suzlon |

India |

6 |

| Siemens |

Germany |

5 |

| United Power |

China |

4 |

| Source: Various reports |

Having made a mark in wind energy installations, China is

also seen slowly penetrating the global WTG market and India

is no exception. Reliable reports suggest that China today has

four of its manufacturers in the world's top ten makers of wind

turbines. Sinovel of China is the world's second-largest manufacturer of WTG with a 11 per cent market share, closely

following world leader Vestas of Denmark that has 12 per cent.

Chinese equipment has even entered developed markets like

USA and UK, apart from emerging markets like Ethiopia, Cuba

and Pakistan.

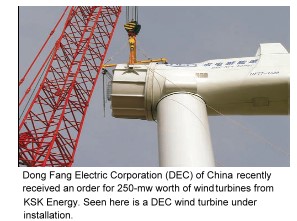

China received a big boost in India very recently when KSK

Energy placed a large order of 125 turbines of 2-mw each on

Shanghai Electric Company. For the Chinese company, it was

a significant penetration of global markets, considering that

before this, it had sold only five turbines outside its home

country. In late 2010, the same developer KSK Energy decided

to source 66 units of 1.5-mw direct drive turbines from

Chinese player Donfang Electric Corporation.

China's role in India's thermal power generation has been a

subject of big debate, and in the coming years, one may witness

wind energy toeing the line.

CONCLUSION

The Indian WTG manufacturing industry is seen maturing.

Smaller players-those that made turbines of 250kW or

lower-are disappearing, making space for global names.

With India expecting to add around 2 GW of new wind

power capacity per year, the WTG industry needs to keep

pace. Most of the international giants have had a long

presence in India, and those who did not, are following fast.

Given India's wind power potential, there is tremendous

scope for domestic WTG capacity. This apart, there is also

great export potential, particularly of sophisticated wind

turbines for offshore applications.

The biggest hurdle that one needs to encounter is the

absence of a robust supply chain and weak logistical support.

In fact, these are the very issues are impinge upon India's

efforts to build capacity in the manufacturing sector, even

generally speaking.

The issues in creation of WTG capacity is reminiscent of

what is happening in the thermal power equipment spaceemergence

of new players, progressive growth in technology

and a growing "interest" from China. India's Sino neighbour

has created tremendous WTG manufacturing capacity given

that it has commissioned 40 GW of wind farms over the past

four years, largely with domestic equipment. India's approach

to Chinese wind turbines, amidst the growing number of

domestic options available, would be worth observing.