Thermal power plants, mainly coal-based, will continue to form the backbone of India's power generation infrastructure. With the XI plan drawing to a close,

Venugopal Pillai, in this special study takes a look at India's thermal power capacity addition programme in the ongoing Plan period. It is heartening to note that the country is on course to achieving over 85 per cent of the targeted thermal power capacity. The study also takes a detailed note of the new paradigms in the thermal power equipment industry.

The X Plan period (2002-07) had seen the power sector

perform disastrously in terms of addition of new

capacity. Additions were less than half of the 41,110

mw capacity targeted for the period. The X Plan had

envisaged 25,417 mw of new thermal power generation

capacity, mainly in the government sector. As against this,

actual addition was only 12,114 mw. Fingers were pointed

at Central PSU Bharat Heavy Electricals Ltd for the delay.

BHEL was responsible for a good part of the capacity

addition as it was the unanimous supplier to Central and

state government projects.

The ongoing XI Plan period (2007-12) therefore bequeathed

a huge backlog from its predecessor. Thanks to this and a host

of other factors, the current Plan period is in a much healthier

state. It appears, on the basis of various official data releases,

that the country might be able to add over 85 per cent of the

thermal power capacity envisaged for the Plan period. The

original target for thermal power capacity addition for the XI

Plan stood at 59,693 mw. In the first four years of the Plan

(2007-08 up to 2010-11) thermal power capacity addition

stood at 29,461 mw. As of March 31, 2011, a total of 33,378

mw of new thermal power capacity was under physical construction. Of this, 24,768 mw is likely to commission

during 2011-12. This means that the total thermal power

capacity added in the XI Plan would be in the region of 54,229

mw, representing a target achievement of 90 per cent.

THERMAL CAPACITY ADDITION: X PLAN |

|

Central |

State |

Private |

Total |

| 2002-03 |

2002-03 |

665 |

348 |

2,223 |

| 2003-04 |

710 |

652 |

0 |

1,362 |

| 2004-05 |

2,210 |

654 |

70 |

2,934 |

| 2005-06 |

500 |

428 |

661 |

1,589 |

| 2006-07 |

1,960 |

1,155 |

892 |

4,007 |

| Total |

6,590 |

3,554 |

1,971 |

12,114 |

| % share |

54.4 |

29.3 |

16.3 |

100.0 |

WHAT MAKES THE XI PLAN DIFFERENT?

On several counts, the XI Plan period defines a shift of

paradigm in India's power sector. Everything stands

transformed-right from thinking to planning to execution.

In terms of thermal power capacity addition, the key

changes have been: a gradual decline in market share of

BHEL as the main plant equipment supplier; the emergence

of a new class of suppliers that predominantly includes

Chinese companies; and the phenomenal growth in the

class of independent power producers (private sector power

generation companies). Thus, both on the equipment

supply side and the power plant ownership side, there is a

significant loosening of the traditional public sector grip.

In the X Plan period, private sector companies added only

16.3 per cent of the total thermal power capacity added. In

the first four years of the XI Plan period, this metric more

than doubled to 34 per cent. In the coming years, private

sector will consistently account for over half of the new

capacity envisaged.

BHEL: TIME TO REINVENT

BHEL, which was the sole supplier of equipment for thermal

power plants, is gradually seeing its market share decline.

This fall only reflects the fact that the Central PSU

engineering giant could not have kept pace with India's

power capacity demands. BHEL had a share of around 85 per

cent in new thermal power capacity added in the X Plan

period and this is expected to fall to 62 per cent in the XI Plan

period, according to projections made by Electrical Monitor.

On its part, BHEL is taking steps to improve its prospects

in the thermal power equipment space in the wake of

competition from private and foreign suppliers, including

those from China. BHEL is in the midst of a major capacity

expansion drive where it is not only expanding its overall

capacity but also improving its technological capabilities,

most important of which is manufacturing thermal power

equipment with supercritical parameters.

At the beginning of the XI Plan period, BHEL had an annual

manufacturing capacity of around 7,000 mw, which barely met the country's demands. It has embarked on a major

expansion drive aiming at capacity of 20,000 mw by 2012.

Fiscal year 2010-11 was eventful, seeing capital expenditure

of

1,771 crore-the highest in any year so far by BHEL. As of

March 2011, BHEL's capacity had reached 15,000 mw and the

PSU engineering giant was well on course to attaining the

20,000-mw mark by March 2012. As of end-March this year,

BHEL had commissioned 82 machines out of the 251

machines in its capacity expansion drive.

THERMAL POWER CAPACITY ADDITION: XI PLAN |

|

Central |

State |

Private |

Total |

(MW) |

| 2007-08 |

1,990 |

3,880 |

750 |

6,620 |

| 2008-09 |

750 |

852 |

883 |

2,485 |

| 2009-10 |

1,740 |

3,079 |

4,287 |

9,106 |

| 2010-11 |

3,740 |

2,581 |

4,930 |

11,251 |

| (% share) |

| 2007-08 |

30.1 |

58.6 |

11.3 |

100.0 |

| 2008-09 |

30.2 |

34.3 |

35.5 |

100.0 |

| 2009-10 |

19.1 |

33.8 |

47.1 |

100.0 |

| 2010-11 |

33.2 |

22.9 |

43.8 |

100.0 |

BHEL's inevitable decline in market share is already

perceptible. Estimates released by the Union power

ministry indicate that in thermal power projects targeted to

commission in the XII Plan period for which orders for main

plant machinery have been placed, BHEL has a share of 41.4

per cent that is even lower than of Chinese suppliers. The

Central PSU has lost out on business in both conventional

and supercritical power equipment.

Apart from the imminent capacity expansion that would

enable BHEL to bid for a larger number of projects in future,

BHEL has outlined two important strategies—equipment

financing and joint ventures-in a bid to regain its lost

market share. It is also important to note that BHEL is

trying to find new business areas, power transmission for

instance, to diversify its business portfolio.

Equipment financing: Thanks to its huge reserves of

nearly

10,000 crore, BHEL has proposed to set up a

financing arm. Under this model, BHEL would finance

power generation projects in the private sector, with the

understanding that orders for main plant equipment would

be placed with the engineering company. This financing

arm proposal, for which consultants have already been

appointed, should be formalized in the near future.

Joint ventures: As mentioned earlier, BHEL has lost out

on much supercritical equipment business because the

company took much longer than anticipated to equip itself

with technology. This delay has ushered in a slew of foreign

suppliers—Russian, Chinese and Japanese. To be able to

"secure" supercritical equipment orders, BHEL has proposed

to set up joint ventures with state-owned power generation

companies. Under this agreement, BHEL would be a

minority partner with 26 per cent equity stake and also the

deemed supplier of main plant equipment. Agreements of

this type have been reached with power generation utilities

in Tamil Nadu, Karnataka and Madhya Pradesh. Discussions are on with Gujarat, Maharashtra and Andhra

Pradesh. Analysts agree that this has by far been the biggest

move by BHEL to secure supercritical equipment business

and also initiate its role as an independent power producer.

Order book: During 2010-11, BHEL received orders

worth

46,393 crore in the power sector and its overall order

book position, as of March 31, 2011, stood at a whopping

1,64,130 crore with the power sector accounting for

around 70 per cent.

BHEL's declining market share is evident in physical

terms. In 2010-11, BHEL's power sector orders

corresponded to a capacity of 15,071 mw, which has been a

steady decline from 16,489 mw in 2009-10 and 17,020 mw

in 2008-09. In value terms, however, BHEL's power sector

order inflow of

46,393 crore in 2010-11 was much higher

than

41,976 crore in 2009-10 and

44,407 crore in 2008-09.

This only indicates that

BHEL has been getting

higher per-mw

realization, ostensibly

because it has begun

supplying supercritical

power equipment.

BHEL'S ORDER INFLOW* |

|

MW |

`crore |

| 2008-09 |

17,020 |

44,407 |

| 2009-10 |

16,489 |

41,976 |

| 2010-11 |

15,071 |

46,393 |

| *only power sector |

While public sector

projects have been the

thrust area for BHEL,

the engineering firm is beginning to witness a growing

stream of private sector orders. While statistics for 2010-11

are not yet available, in 2009-10, BHEL witnessed an

unprecedented 80 per cent private sector share in the power

order inflow.

According to an analysis carried out by Electrical Monitor,

BHEL is supplying equipment worth 20,820 mw to thermal

power projects currently under construction and expected

to commission by March 2012. This gives it a market share

of 62 per cent.

Official statistics indicate that orders for new thermal

power capacity worth 67,016 mw have been placed, with

commissioning targeted in the XII Plan. Out of this, BHEL

has received orders worth 27,746 mw, or 41 per cent.

AHEAD OF SCHEDULETill the advent of the private sector, commissioning of a

power plant before schedule was an unknown phenomenon.

A gestation period of six to seven years for a commercialscale

thermal power plant was considered perfectly normal.

With the advent of the private sector, gestation period are

getting compressed. This has been due to faster availability

of equipment, better project planning and scientific project

implementation techniques. It is not just with private sector

companies, even public sector entities like NTPC and

Damodar Valley Corporation are commissioning their

power plants in significantly shorter schedules.

In 2010-11 alone, at least 1,200 mw of new thermal power

capacity came on stream ahead of schedule. This was a significant 10 per cent of the total capacity commissioned in

that year. More than half of this capacity was from private

sector entities. In 2011-12, the terminal year of the XI Plan

period, a similar feat is expected. For instance, private

developers of the Sasan and Mundra ultra mega power

projects are hopeful of commissioning some power units in

2011-12, making it at least two years ahead of schedule.

UPCOMING SUPERCRITICAL POWER PROJECTS* |

| Promoter |

Project |

Unit |

Total |

Location |

BTG Supplier |

| |

|

Rating |

Capacity |

|

|

| |

|

(MW) |

|

|

| NTPC |

Barh-I |

660 |

1,980 |

Bihar |

Technoprom, Russia |

| NTPC |

Barh-II |

660 |

1,320 |

Bihar |

BHEL |

| NTPC** |

Sipat-I |

660 |

1,980 |

Chhattisgarh |

BHEL |

| Mahagenco |

Koradi |

660 |

1,980 |

Maharashtra |

L&T-MHI |

| Reliance Power |

Sasan UMPP |

660 |

3,960 |

Madhya Pradesh |

Shanghai Electric |

| Reliance Power |

Krishnapatnam UMPP |

660 |

3,960 |

Andhra Pradesh |

Shanghai Electric |

| Tata Power |

Mundra UMPP |

800 |

4,000 |

Gujarat |

Doosan + Toshiba |

| Adani Power** |

Mundra-II |

660 |

1,320 |

Gujarat |

SEPCO-III, China |

| Adani Power |

Mundra-III |

660 |

1,980 |

Gujarat |

SEPCO-III, China |

| Jaiprakash Group |

Bara |

660 |

1,980 |

Uttar Pradesh |

BHEL |

| Jaiprakash Group |

Nigri |

660 |

1,320 |

Madhya Pradesh |

L&T-MHI |

| *Only projects under physical construction **partially commissioned (Note:List may not be exhaustive) |

Industry experts feel that better project management

skills, which are rapidly evolving in India's power sector,

will contribute towards even faster project execution in the

years ahead.

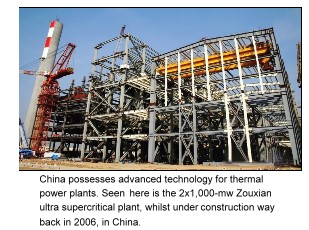

ROLE OF CHINA

A defining episode of India's power sector in recent years has

been the blazing entry of Chinese equipment. What began as

sporadic orders for low-rating equipment has now turned

into a formidable stream of sophisticated machinery being

ordered by India's biggest private power producers. The flow

of Chinese equipment looks like an unstoppable

phenomenon, whatever be the concerns revolving on inferior

quality, lack of sales support, non-availability of spares, etc.

It is estimated that India has placed more orders on Chinese

equipment than on domestic supplier BHEL, insofar as

thermal power equipment for XII Plan projects go. The power

ministry has estimated that orders have been placed for

67,016 mw worth of thermal power projects targeted to

commission during the XII Plan period. Out of this China has

to its credit 28,740 mw, accounting for 43 per cent. By the

same comparison, BHEL had orders worth a lower 27,746 mw.

ORDERS FOR THERMAL POWER PLANTS* |

Supplier |

MW |

% share |

| DOMESTIC |

| BHEL |

27,746 |

41.4 |

| Others |

6,150 |

9.2 |

| Sub-total |

33,896 |

50.6 |

| INTERNATIONAL |

| China |

28,740 |

42.9 |

| Others |

4,380 |

6.5 |

| Sub-total |

33,120 |

49.4 |

| Grand Total |

67,016 |

100.0 |

| *Plants under construction and expected to commission in XII Plan |

According to an analysis made by Electrical Monitor based

on official statistics, Chinese equipment accounts for

20,820 mw of thermal power capacity currently under

construction and likely to commission by the end of the XI

Plan period. This is out of a total of 33,378 mw. Some plants

using Chinese equipment have already been commissioned.

Taking this into account, around 35 per cent of new thermal capacity commissioned in the XI Plan period would be

based on Chinese equipment. Prominent suppliers from

China have been Dong Fang, Shanghai Electric, SEPCO III,

to name a few.

Leading independent power producers like Reliance

Power, Adani Power, GMR Group and Sterlite Energy have

placed an abundance of orders on Chinese suppliers. In fact,

China-made equipment would form the backbone of the

thermal power ambitions of these emerging IPPs.

In October last year, Anil Ambani-controlled Reliance

Power signed a historic deal with Shanghai Electric Group

Company (SEC) for the supply of 36 coal-fired supercritical

units aggregating 30,000 mw, over a ten-year period. The deal

was worth $8.3 billion, making it amongst the single-largest

power deals globally. Taking into account equipment sourced

from SEC in the past, the deal is worth over $10 billion.

Electrical Monitor feels that this deal can potentially change

the way India has looked at Chinese suppliers, no matter

what the downside of Chinese power equipment is.

A growing endorsement to Chinese equipment had first

come in November 2009 when Lanco Group placed a

10,000-crore order on Dong Fang Electric for six

supercritical power units of 660-mw each. Even Adani

Power has largely been in favour of Chinese equipment

and so has Vedanta Group company Sterlite Energy. Adani

Power is currently building at least nine supercritical

power units of 660-mw each-in Maharashtra and Gujaratall

sourced from Chinese vendors. Sterlite Energy has

sourced main plant equipment from SEPCO-III for its

4x600-mw Jharsuguda power plant in Orissa, the first IPP

project in the eastern state. Two units out of the four are

already in operation.

The reasons for Indian power developers favouring

Chinese equipment are not far to seek. It is established that

India's mainstay equipment supplier BHEL is overloaded

and there are no immediate domestic alternatives. China

today has the ability to deliver thermal power equipmentboth

sub-critical and supercritical-with minimum lead

time. Plus, equipment from China is at least 20 per cent

cheaper than any alternative, domestic or imported. These

have been virtues that Indian power producers find

irresistible. Of late, China has also been offering attractive

financing options, making the case strongly in favour of

Sino equipment even stronger.

India has never banned the import of Chinese equipment

but at the same time has not been able to control it.

Domestic players like BHEL and Larsen & Toubro have since

long demanded the imposition of a higher import duty for

Chinese power gear, but to no avail. One has to tacitly

understand that Chinese equipment will be responsible for

at least 30 per cent of the new thermal power generation

capacity that will be created in the XI and XII Plan periods.

In this sense, it is helping India reach its power capacity

targets. Imposition of additional import duty could be

counterproductive, whatever be the argument against

Chinese equipment, industry experts feel.

THERMAL POWER EQUIPMENT: NEW ENTRANTS |

| Company |

Equity |

Techno-Financial Partner |

Equity |

Capacity |

Location |

Scope of activities |

|

(%) |

|

(%) |

(MW) |

|

|

| NTPC |

50 |

BHEL |

50 |

5,000 |

Andhra Pradesh |

Main plant equipment, BoP, EPC contracting |

| Larsen & Toubro* |

51 |

Mitsubishi Heavy Inds, Japan |

49 |

6,000 |

Gujarat |

Supercritical boilers & turbine-generators |

| JSW Group |

25 |

Toshiba, Japan |

75 |

3,000 |

Tamil Nadu |

Supercritical turbine-generators |

| Bharat Forge |

49 |

Alstom, France |

51 |

5,000 |

Gujarat |

Supercritical turbine-generators, auxiliaries |

| Thermax |

51 |

Babcock & Wilcox, USA |

49 |

3,000 |

Maharashtra |

Supercritical boilers |

| BGR Energy Systems |

70 |

Hitachi Power Eqpt, Germany |

30 |

4,000 |

Tamil Nadu |

Supercritical boilers & turbine-generators |

| *Separate JVs for boilers and turbine-generators |

Central and state government power utilities have not

sought Chinese equipment per se, but ironically enough, it

is making a backdoor entry through EPC contracts placed

on private sector contractors. A striking case in point is

Damodar Valley Corporation, a Central PSU, which always

ordered its main plant equipment on BHEL. When DVC

decided to adopt the EPC contract route to build its 1,200-

mw Raghunathpur coal-based project in West Bengal, it

ended up selecting Reliance Infrastructure Ltd, which in

turn, ordered main plant equipment from China. Similar

cases have been observed with some state government

utilities as well. The debate for and against Chinese power

equipment can go on incessantly. However, the ground

reality remains that the flow of Chinese equipment in the

country, at least at the moment, is continuing unabated.

THE THIRD ESTATE

The XII Plan period will see the creation of the third estate

of power manufacturing equipment. It will comprise of

over six entities-mainly joint ventures with multinationalsthat

together aim to create power equipment capacity of at

least 25,000 mw. This, for a frame of reference, is

comparable to the size of BHEL. The XII Plan period and

beyond, will therefore see India's thermal power capacity

addition being serviced by three forces—BHEL, Chinese

suppliers and the new crop of equipment makers. By 2014-

15 or so, India's domestic equipment capacity for thermal

power plants should be around 50,000 mw per year, easily

meeting the local demand. This might greatly reduce the

dependence on imports from China, provided that the

incipient capacity meets the attributes of cost-effectiveness

and timely delivery. It is encouraging to see that almost all

the joint ventures will be equipped with technology for

delivering supercritical thermal power equipment, which is

expected to be the technology of choice for all new thermal

(coal-based) power projects to be built in the XIII Plan

period and thereafter.

Here is a summary of the current status of some of the

new entrants in the thermal power equipment

manufacturing space.

L&T-MHI: Larsen & Toubro in 2008 entered into an

agreement with Mitsubishi Heavy Industries of Japan to set

up two separate joint ventures for supercritical boilers and

supercritical turbine-generators, respectively. In January

this year, the two units were commissioned with an initial

capacity of 5,000 mw, to be scaled up to 6,000 mw by 2012.

Both the plants are located at Hazira in Gujarat. The L&TMHI

combine has already won a significant number of

orders for supply of supercritical thermal power equipment.

Its biggest order has been from Mahagenco for the supply of

equipment relating to the 3x660-mw Koradi supercritical

power plant in Nagpur district. Orders have also been

placed by private sector, for instance the 2x660-mw Nigre

supercritical power project in Madhya Pradesh of the

Jaiprakash Group.

Bharat Forge-Alstom: Coming up at Mundra in

Gujarat, the new joint venture turbine-generator plant of

Bharat Forge (49 per cent) and Alstom (51 per cent) is

expected to be ready by 2013. It will produce equipment

worth 5,000 mw annually. The joint venture has been

actively bidding for equipment supply contracts and in the

race for supplying supercritical gear for projects of NTPC

and Damodar Valley Corporation.

NTPC-BHEL: A very significant joint venture, NTPCBHEL

Projects Pvt Ltd represents the coming together of

two biggest PSUs in the ministries of power and heavy

industries, respectively. The two partners intend to invest

6,000 crore to create 5,000 mw of equipment capacity by 2014. Apart from main plant equipment, the JV will also

look at EPC and balance-of-plant contracting. The JV has

already begun booking orders relating to EPC contracting

and balance-of-plant services. NTPC that is aiming at a

power generation portfolio of 75,000 mw by 2017 is likely to

place orders on this JV, apart from BHEL.

Thermax-Babcock & Wilcox: Thermax Babcock

Wilcox Energy Solutions, a joint venture between Thermax

and US-based Babcock & Wilcox, is setting up a plant with

an investment of

120 crore for supercritical boilers.

Coming up at Satara in Maharashtra, the plant spread over

125 acres is likely to start production by June 2012.

BGR Energy-Hitachi: Chennai-based BGR Energy and

Hitachi Power Europe of Germany have come together to

form two separate joint venture for manufacture of

supercritical boilers and turbine-generators respectively.

The facilities, coming up near Chennai, are likely to turn

commercial in the next two years. Debt mobilization is

currently underway and the joint ventures are participating

in the bidding process for supercritical power equipment.

THE WAY AHEAD

The X Plan period (2002-07) was a great learning experience

for the Indian power sector, although there was no

demonstrable progress in terms of augmenting power

generation capacity. The XI Plan (2007-12) is bound to be

much better on all counts. To begin with, the country

would be witnessing, for the first time ever, thermal power

capacity addition averaging a little over 10,000 mw per year.

When seen against 12,114 mw of new thermal power

capacity added in the entire X Plan period, which was then

the best performance ever, the achievement is laudable.

Apart from the physical progress that the thermal power

sector has seen in the XI Plan, much has changed with

respect to the entire endeavour of power capacity addition.

In olden days, setting up of thermal power plants was more

of a slow-moving tripartite activity between Central

government agencies, state electricity boards and Bharat

Heavy Electricals Ltd. The public sector bastion is now

demolished with private sector participation seen across

the board—ownership of power plants, supply of

equipment, EPC contracting, O&M etc.

State owned power generation companies will gradually

move out of the activity of setting up power plants, but

instead award projects to the private sector through tariffbased

competitive bidding. State utilities will also enter

into long-term power supply agreements, again using the

competitive bidding route. The growing involvement of

private sector is therefore inevitable and so is the subdued

role that state government entities will play in ownership

of power plants. When one looks at the 51,536 mw of

thermal power capacity currently under construction and

likely to commission in the XII Plan period, only 22 per cent

is in the state sector while 62 per cent is private.

In the foreseeable future, thermal power capacity of

around 12,000 mw will get added per year. This will

certainly bring about some relief to power shortages and

peak power deficit. On the other hand, the focus will then

shift, and should necessarily so, to efficient operation of

power plants. Issues like fuel management—mainly

securing coal linkages—will come to the fore. Considering

that India's thermal power capacity would have doubled

during the decade ending 2017, the country would need

expertise in operations and maintenance of power plants.

Besides, considerable efficiencies will have to be brought

about in power transmission and distribution.The mission

of energizing a nation starts with the setting up of a power

generation plant. While there are several links ahead in the

power chain, it is reassuring that India is taking its first step

very confidently.

SELECT MEGA THERMAL POWER PROJECTS UNDER CONSTRUCTION* |

| Promoter |

Ownership |

Project |

Location |

MW |

BTG Supplier |

| Tata Power |

Private |

Mundra UMPP |

Gujarat |

4,000 |

Doosan, Toshiba |

| Reliance Power |

Private |

Krishnapatnam UMPP |

Andhra Pradesh |

4,000 |

SEC (China) |

| Reliance Power |

Private |

Sasan UMPP |

Gujarat |

3,960 |

SEC (China) |

| Jindal Power |

Private |

Raigarh |

Chhattisgarh |

2,400 |

BHEL |

| NTPC |

Central |

Barh-I |

Bihar |

1,980 |

Technoprom, Russia |

| Mahagenco |

State |

Koradi |

Maharashtra |

1,980 |

L&T |

| Jaiprakash Group |

Private |

Prayagraj |

Uttar Pradesh |

1,980 |

BHEL |

| APGenco+IL&FS |

State |

Krishnapatnam |

Andhra Pradesh |

1,600 |

BHEL, L&T-MHI |

| Elena Power (IndiaBulls) |

Private |

Nashik |

Maharashtra |

1,350 |

BHEL |

| Elena Power (IndiaBulls) |

Private |

Amravati |

Maharashtra |

1,350 |

BHEL |

| NTPC |

Central |

Barh-II |

Bihar |

1,320 |

BHEL |

| Jaiprakash Group |

Private |

Nigrie |

Madhya Pradesh |

1,320 |

BHEL |

| RRVUNL |

State |

Kalisindh |

Rajasthan |

1,200 |

BGR Energy |

| MPPGCL |

State |

Malwa |

Madhya Pradesh |

1,200 |

BHEL |

| Essar Power |

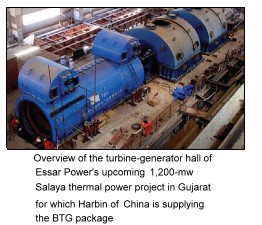

Private |

Salaya |

Gujarat |

1,200 |

Harbin (China) |

| Essar Power |

Private |

Mahan |

Madhya Pradesh |

1,200 |

Harbin (China) |

| CLP India |

Private |

Jhajjar |

Haryana |

1,200 |

Sepco III (China) |

| Jindal India Thermal Power |

Private |

Derang |

Orissa |

1,200 |

BHEL |

| Coastal Energen |

Private |

Tuticorin |

Tamil Nadu |

1,200 |

Harbin (China) |

| Monnet Power |

Private |

Malibrahmani |

Orissa |

1,050 |

BHEL |

| GMR Energy |

Private |

Kamalanga |

Orissa |

1,050 |

Sepco III (China) |

| *Expected to fully commission in XII Plan period |